eBay 2012 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2012 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the banks. The negative covenants include restrictions regarding the incurrence of liens, subject to certain exceptions. The financial covenant

requires us to meet a quarterly financial test with respect to a minimum consolidated interest coverage ratio.

As of December 31, 2012 , we were in compliance with all covenants in our outstanding debt instruments.

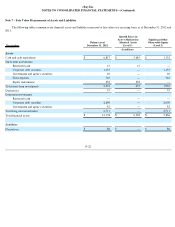

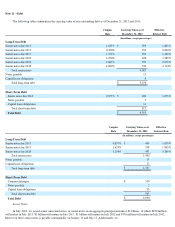

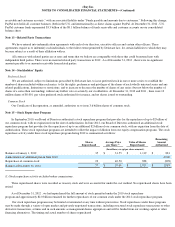

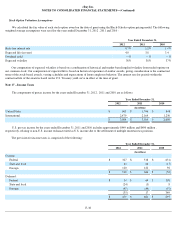

Future Maturities

Expected future principal maturities as of December 31, 2012 are as follows (in millions):

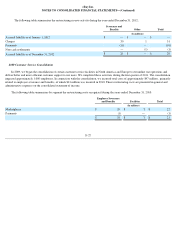

Note 12 – Commitments and Contingencies

Commitments

As of December 31, 2012 , approximately $12.4 billion

of unused credit was available to Bill Me Later accountholders. While this amount

represents the total unused credit available, we have not experienced, and do not anticipate, that all of our Bill Me Later accountholders will

access their entire available credit at any given point in time. In addition, the individual lines of credit that make up this unused credit are subject

to periodic review and termination by the chartered financial institution that is the issuer of Bill Me Later credit products based on, among other

things, account usage and customer creditworthiness. When a consumer makes a purchase using a Bill Me Later credit product issued by a

chartered financial institution, the chartered financial institution extends credit to the consumer, funds the extension of credit at the point of sale

and remits funds to the merchant. We subsequently purchase the receivables related to the consumer loans extended by the chartered financial

institution and, as a result of the purchase, bear the risk of loss in the event of loan defaults. Although the chartered financial institution continues

to own each customer account, we own the related receivable, and Bill Me Later is responsible for all servicing functions related to the account.

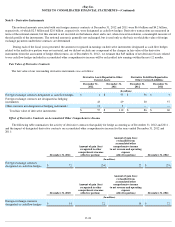

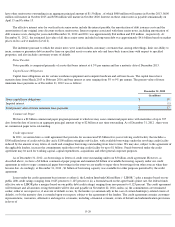

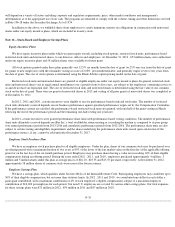

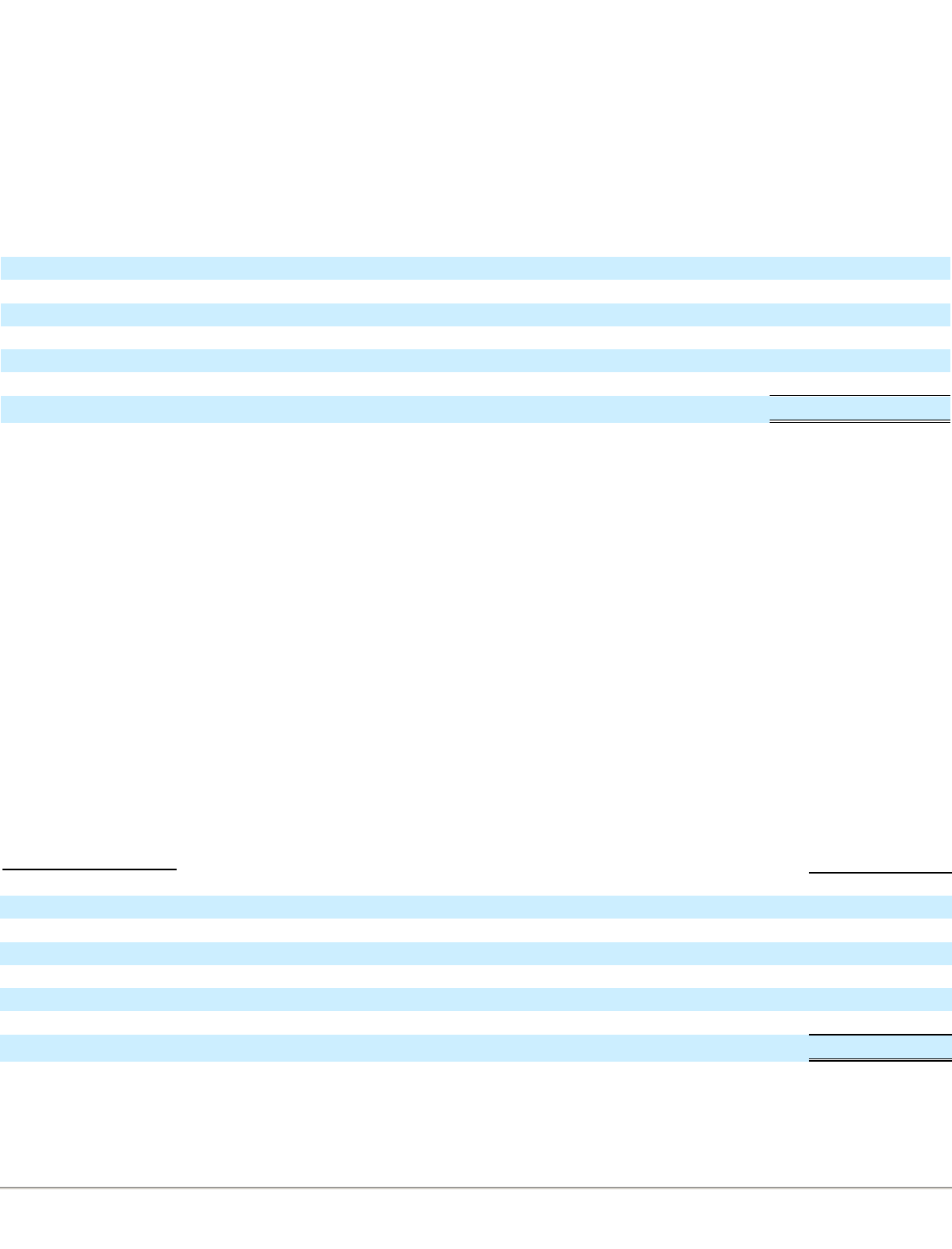

Lease Arrangements

We have lease obligations under certain non-cancelable operating leases. Future minimum rental payments under our non-cancelable

operating leases at December 31, 2012 are as follows:

Rent expense in the years ended December 31, 2012 , 2011 and 2010 totaled $152 million , $131 million and $113 million , respectively.

F-30

Fiscal Years:

2013

$

413

2014

19

2015

850

2016

—

2017

1,000

Thereafter

2,250

$

4,532

Year Ended December 31,

Leases

(In millions)

2013

$

99

2014

80

2015

67

2016

45

2017

36

Thereafter

43

Total minimum lease payments

$

370