eBay 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Our Payments segment earns net transaction revenues primarily from processing transactions for customers. Revenues resulting from a

payment processing transaction are recognized once the transaction is completed.

Our GSI segment generates net transaction revenues primarily from providing ecommerce technology, order processing, fulfillment and

customer care services to its clients. The revenues can be fixed or variable and are based on the activity performed and/or the value of

merchandise sold. Revenues are recognized as the underlying activity is performed or upon shipment of the underlying merchandise.

Our marketing services and other revenues, included in all of our segments, are derived principally from the sale of advertisements,

revenue sharing arrangements, classifieds fees, marketing service fees and lead referral fees, as well as the revenues described in the next

paragraph. Our advertising revenues are derived principally from the sale of online advertisements. The duration of our advertising contracts has

ranged from one week to five years, but is generally one week to one year. Advertising revenues on contracts are recognized as

“impressions” (i.e., the number of times that an advertisement appears in pages viewed by users of our websites) are delivered, or as

“clicks” (which are generated each time users on our websites click through our text-based advertisements to an advertiser's designated website)

are provided to advertisers. For contracts with minimum monthly or quarterly advertising commitments where the fee and commitments are

fixed throughout the term, we recognize revenue ratably over the term of the agreement. Some of our advertising contracts consist of multiple

elements which generally include a blend of various impressions and clicks as well as other marketing deliverables. Where neither vendor-

specific objective evidence nor third-

party evidence of selling price exists, we use management's best estimate of selling price (BESP) to allocate

arrangement consideration on a relative basis to each element. BESP is generally based on the selling prices of the various elements when they

are sold to customers of a similar nature and geography on a stand-alone basis or estimated stand-alone pricing when the element has not

previously been sold stand-alone. These estimates are generally based on pricing strategies, market factors and strategic objectives. Revenues

related to revenue sharing arrangements are recognized based on revenue reports received from our partners, provided that collectability is

reasonably assured. Revenues related to fees for listing items on our classified websites are recognized over the estimated period of the classified

listing. Lead referral fee revenue is generated from lead referral fees based on the number of times a user clicks through to a merchant's website

from our websites. Lead referral fees are recognized in the period in which the user clicks through to the merchant's website.

Our other revenues are derived principally from contractual arrangements with third parties that provide services to our users, interest

earned on certain PayPal customer account balances and interest and fees earned on the Bill Me Later portfolio of loan receivables. Revenues

from contractual arrangements with third parties are recognized as the contracted services are delivered to end users. Interest income on certain

PayPal customer balances is recognized when earned. Interest and fees earned on the Bill Me Later portfolio of loan receivables are computed

and recognized based on contractual interest and fee rates, and are net of any required reserves and amortization of deferred origination costs.

To drive traffic to our websites, we provide incentives to our users in the form of coupons and buyer and seller rewards. These incentives

are generally treated as reductions in revenue.

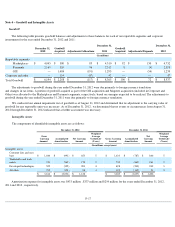

Internal use software and website development costs

Direct costs incurred to develop software for internal use and website development costs are capitalized and amortized over an estimated

useful life of one to five years. During the years ended December 31, 2012, 2011 and 2010 , we capitalized costs, primarily related to labor and

stock-based compensation, of $285 million , $212 million and $193 million , respectively. Amortization of previously capitalized amounts was

$184 million , $166 million and $147 million for 2012 , 2011 and 2010 , respectively. Costs related to the design or maintenance of internal use

software and website development are expensed as incurred.

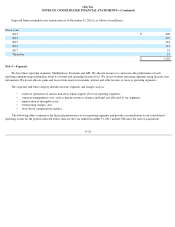

Advertising expense

We expense the costs of producing advertisements at the time production occurs and expense the cost of communicating advertisements in

the period during which the advertising space or airtime is used as sales and marketing expense. Internet advertising expenses are recognized

based on the terms of the individual agreements, which is generally over the greater of the ratio of the number of impressions delivered over the

total number of contracted impressions, on a pay-per-click basis, or on a straight-line basis over the term of the contract. Advertising expense

totaled $1.1 billion , $977 million and $808 million for the years ended December 31, 2012, 2011 and 2010 , respectively.

F-9