eBay 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our developer platforms, which are open to merchants and third-party developers, subject us to additional risks.

In 2009, we launched the PayPal Developer Platform to enable third-party developers to access a wide variety of PayPal product and

programming code specifications and to connect to select PayPal payment application programming interfaces (APIs). We also began providing

a software tool kit for building mobile payments applications, and enabling third-party developers to access certain APIs with respect to our

Marketplaces platforms. In August 2011, we acquired Magento, Inc. (now X.commerce, Inc.) which includes an open platform for merchants

and developers. There can be no assurance that merchants or third-party developers will develop and maintain applications and services on our

open platforms on a timely basis or at all, and a number of factors could cause such third-party developers to curtail or stop development for our

platforms. In addition, our business is subject to many regulatory restrictions, which may be contravened by such third party applications. If this

were to occur, we could be liable for the regulatory failure and our business could be adversely affected.

There are risks associated with our indebtedness.

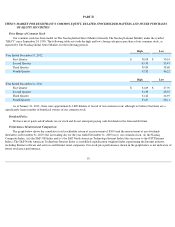

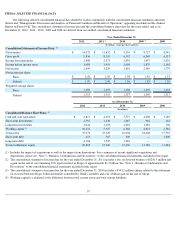

At December 31, 2012, we had approximately $4.5 billion of senior unsecured indebtedness and no indebtedness outstanding under our

$2.0 billion commercial paper program, although from time to time we have made substantial borrowings under our commercial paper program.

We also have a $3.0 billion revolving credit facility, under which we maintain $2.0 billion of available borrowing capacity in order to repay

commercial paper borrowings in the event we are unable to repay those borrowings from other sources when they come due. As of December 31,

2012, no borrowings or letters of credit were outstanding under this revolving credit facility and, accordingly, $1.0 billion of borrowing capacity

was available for other purposes permitted by this credit facility.

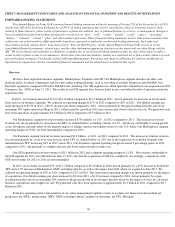

We may incur additional indebtedness in the future, including under our commercial paper program and revolving credit facility or through

public or private offerings of debt securities. Our outstanding indebtedness and any additional indebtedness we incur may have important

consequences, including, without limitation, the following:

Our ability to make payments of principal of and interest on our indebtedness depends upon our future performance, which will be subject

to general economic conditions, industry cycles and financial, business and other factors affecting our consolidated results of operations and

financial condition, many of which are beyond our control. If we are unable to generate sufficient cash flow from operations in the future to

service our debt, we may be required to, among other things:

Such measures might not be sufficient to enable us to service our debt. In addition, any such financing, refinancing or sale of assets might

not be available on economically favorable terms or at all.

We depend on the continued growth of online and mobile commerce.

The business of selling goods over the Internet and mobile networks, particularly through online trading, is dynamic and relatively new.

Concerns about fraud, privacy and other problems may discourage additional consumers from adopting the Internet or mobile devices as modes

of commerce, or may prompt consumers to offline channels. In countries such as the U.S., Germany, Korea and the U.K., where our services and

online commerce generally have been available for some time and the level of market penetration of our services is high, acquiring new users for

our services may be more difficult and costly than it has been in the past. Moreover, the growth rates of Internet users are slowing in many

countries where we have a significant presence. In order to expand our user base, we must appeal to and acquire consumers who historically

have used traditional means of commerce to purchase goods and may prefer Internet analogues to such traditional retail means, such as the

retailer's

49

•

we will be required to use cash to pay the principal of and interest on our indebtedness;

•

our indebtedness and leverage may increase our vulnerability to adverse changes in general economic and industry conditions, as well

as to competitive pressure;

•

adverse changes in the ratings assigned to our debt securities by credit rating agencies will likely increase our borrowing costs;

• our ability to obtain additional financing for working capital, capital expenditures, acquisitions, share repurchases and other general

corporate and other purposes may be limited; and

•

our flexibility in planning for, or reacting to, changes in our business and our industry may be limited.

•

repatriate funds to the U.S. at substantial tax cost;

•

seek additional financing in the debt or equity markets;

•

refinance or restructure all or a portion of our indebtedness;

•

sell selected assets;

•

reduce or delay planned capital expenditures; or

•

reduce or delay planned operating expenditures.