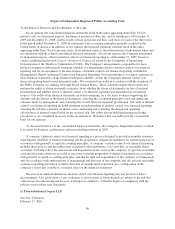

eBay 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

significant influence are accounted for using the equity method of accounting and the investment balance is

included in long-term investments, while our share of the investees’ results of operations is included in interest

and other income, net. Investments in private entities where we hold less than a 20% ownership interest and

where we do not have the ability to significantly influence the operations of the investee are accounted for using

the cost method of accounting, where our share of the investees’ results of operations is not included in our

consolidated statement of income, except to the extent of earnings distributions actually received from the

investee, and the cost basis of our investments is included in long-term investments.

Certain prior period balances have been reclassified to conform to the current period presentation.

Cash and cash equivalents

Cash and cash equivalents are short-term, highly liquid investments with original maturities of three months

or less when purchased.

Investments

Short-term investments, which include marketable equity securities, time deposits and government and

corporate bonds with original maturities of greater than three months but less than one year when purchased, are

classified as available-for-sale and are reported at fair value using the specific identification method. Unrealized

gains and losses are excluded from earnings and reported as a component of other comprehensive income (loss),

net of related estimated tax provisions or benefits.

Long-term investments include government and corporate bonds, time deposits and cost and equity method

investments. Debt securities and time deposits are classified as available-for-sale and are reported at fair value

using the specific identification method. Unrealized gains and losses are excluded from earnings and reported as

a component of other comprehensive income (loss), net of related estimated tax provisions or benefits. Our

equity method investments are investments in privately held companies where we have the ability to exercise

significant influence, but not control, over the investee. These investments include identifiable intangible assets,

deferred tax liabilities and goodwill. Our consolidated results of operations include, as a component of interest

and other income, net, our share of the net income or loss of the equity method investments together with

amortization expense relating to acquired intangible assets. Our share of investees’ results of operations is not

significant for any period presented. Our cost method investments consists of investments in privately held

companies where we do not have the ability to exercise significant influence, or have control over the investee.

These investments are recorded at cost and are subject to periodic tests for other-than-temporary impairment.

We assess whether an other-than-temporary impairment loss on our investments has occurred due to

declines in fair value or other market conditions. This assessment takes into account our intent to sell the

security, whether it is more likely than not that the we will be required to sell the security before recovery of its

amortized cost basis, and if we do not expect to recover the entire amortized cost basis of the security (that is, a

credit loss exists). Other-than-temporary impairments are separated into amounts representing credit losses which

are recognized in the consolidated statement of income and amounts related to all other factors which are

recognized in other comprehensive income (loss). We did not recognize an other-than-temporary impairment loss

on our investments in 2009.

Fair value of financial instruments

Our financial instruments, including cash, cash equivalents, accounts receivable, loans and interest

receivable, funds receivable, customer accounts, accounts payable, funds payable and amounts due to customers

are carried at cost, which approximates their fair value because of the short-term maturity of these instruments.

87