eBay 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

accounting policies reflect the more significant estimates and assumptions used in the preparation of our

consolidated financial statements. The following descriptions of critical accounting policies, judgments and

estimates should be read in conjunction with our consolidated financial statements and other disclosures included

in this report.

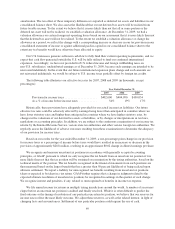

Provision for Transaction and Loan Losses

Provision for transaction and loan losses primarily consists of bad debt expense associated with our

accounts receivable balance, loan reserves associated with our principal loan receivable balance, and PayPal

transaction loss expense, as well our losses resulting from our customer protection programs. Provisions for these

items represent our estimate of actual losses based on our historical experience, actuarial techniques, the age and

delinquency rates of receivables, the credit quality of the relevant loan, as well as economic and regulatory

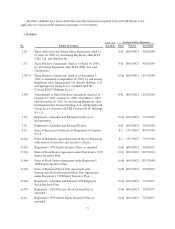

conditions. The following table illustrates the provision as a percentage of net revenues for 2007, 2008 and 2009

(in thousands, except percentages):

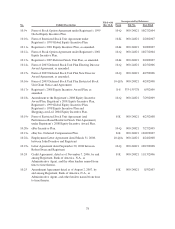

Year Ended December 31,

2007 2008 2009

Net revenues ............................................. $7,672,329 $8,541,261 $8,727,362

Provision for transaction and loan losses ....................... $ 293,917 $ 347,453 $ 382,825

Provision for transaction and loan losses as a % of net revenues ..... 3.8% 4.1% 4.4%

Determining appropriate allowances for these losses is an inherently uncertain process, and ultimate losses

may vary from the current estimates. We regularly update our allowance estimates as new facts become known

and events occur that may impact the settlement or recovery of losses. The allowances are maintained at a level

we deem appropriate to adequately provide for losses incurred at the balance sheet date. An aggregate 50 basis

point deviation from our estimates would have resulted in an increase or decrease in operating income of

approximately $43.6 million in 2009 resulting in an approximate $0.03 change in diluted earnings per share.

Legal Contingencies

In connection with certain pending litigation and other claims, we have estimated the range of probable loss,

net of expected recoveries, and provided for such losses through charges to our consolidated statement of

income. These estimates have been based on our assessment of the facts and circumstances at each balance sheet

date and are subject to change based upon new information and future events.

From time to time, we are involved in disputes that arise in the ordinary course of business. We are

currently involved in certain legal proceedings as discussed in “Item 1A: Risk Factors,” “Item 3: Legal

Proceedings” and “Note 13 — Commitments and Contingencies — Litigation and Other Legal Matters” to the

consolidated financial statements included in this report. We believe that we have meritorious defenses to the

claims against us, and we intend to defend ourselves vigorously. However, even if successful, our defense against

certain actions will be costly and could divert our management’s time. If the plaintiffs were to prevail on certain

claims, we might be forced to pay significant damages and licensing fees, modify our business practices or even

be prohibited from conducting a significant part of our business. Any such results could materially harm our

business and could result in a material adverse impact on the financial position, results of operations or cash

flows of either or both of our business segments.

Accounting for Income Taxes

We are required to recognize a provision for income taxes based upon the taxable income and temporary

differences for each of the tax jurisdictions in which we operate. This process requires a calculation of taxes

payable under currently enacted tax laws around the world and an analysis of temporary differences between the

book and tax bases of our assets and liabilities, including various accruals, allowances, depreciation and

68