eBay 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

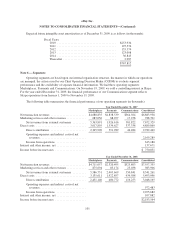

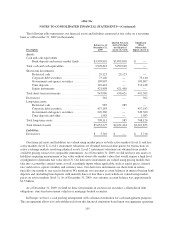

In January 2010, the FASB issued new accounting guidance related to the disclosure requirements for fair

value measurements and provides clarification for existing disclosures requirements. More specifically, this

update will require (a) an entity to disclose separately the amounts of significant transfers in and out of Levels 1

and 2 fair value measurements and to describe the reasons for the transfers; and (b) information about purchases,

sales, issuances and settlements to be presented separately (i.e. present the activity on a gross basis rather than

net) in the reconciliation for fair value measurements using significant unobservable inputs (Level 3 inputs). This

guidance clarifies existing disclosure requirements for the level of disaggregation used for classes of assets and

liabilities measured at fair value and requires disclosures about the valuation techniques and inputs used to

measure fair value for both recurring and nonrecurring fair value measurements using Level 2 and Level 3 inputs.

The new disclosures and clarifications of existing disclosure are effective for fiscal years beginning after

December 15, 2009, except for the disclosure requirements for related to the purchases, sales, issuances and

settlements in the rollforward activity of Level 3 fair value measurements. Those disclosure requirements are

effective for fiscal years ending after December 31, 2010. We do not believe the adoption of this guidance will

have a material impact to our consolidated financial statements.

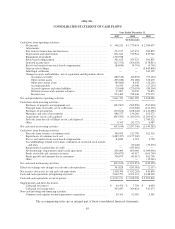

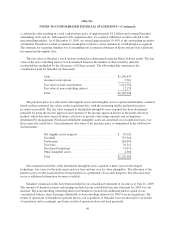

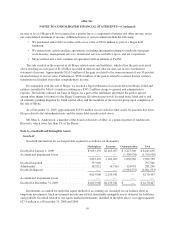

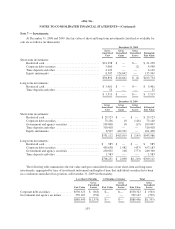

Note 2 — Net Income Per Share:

Basic net income per share is computed by dividing the net income for the period by the weighted average

number of common shares outstanding during the period. Diluted net income per share is computed by dividing

the net income for the period by the weighted average number of shares of common stock and potentially dilutive

common stock outstanding during the period. The dilutive effect of outstanding options and restricted stock units

is reflected in diluted earnings per share by application of the treasury stock method. The calculation of diluted

net income per share excludes all anti-dilutive shares. The following table sets forth the computation of basic and

diluted net income per share for the periods indicated (in thousands, except per share amounts):

Year Ended December 31,

2007 2008 2009

Numerator:

Net income ............................................ $ 348,251 $1,779,474 $2,389,097

Denominator:

Weighted average common shares — basic ................... 1,358,797 1,303,454 1,289,848

Dilutive effect of equity incentive plans .................. 17,377 9,154 15,133

Weighted average common shares — diluted .................. 1,376,174 1,312,608 1,304,981

Net income per share:

Basic ................................................. $ 0.26 $ 1.37 $ 1.85

Diluted ................................................ $ 0.25 $ 1.36 $ 1.83

Common stock equivalents excluded from income per diluted share

because their effect would have been anti-dilutive ................ 83,422 102,642 53,026

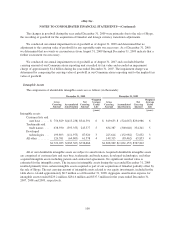

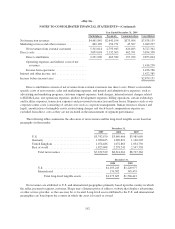

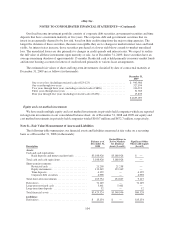

Note 3 — Business Combinations:

Our acquisitions in 2009, 2008 and 2007 with aggregate purchase prices in excess of $100 million were as

follows:

Gmarket Inc.

On June 15, 2009, we acquired 99.0% of the outstanding securities of Gmarket Inc. (“Gmarket”), a company

organized under the laws of the Republic of Korea. We paid $24 per security, net to the holders in cash, through

95