eBay 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

cash balances held in Europe within the same financial institution (“Aggregate Cash Deposits”). This

arrangement also allows us to withdraw amounts exceeding the Aggregate Cash Deposits up to an agreed-upon

limit. The net balance of the withdrawals and the Aggregate Cash Deposits are used by the financial institution as

a basis for calculating our net interest expense or income. As of December 31, 2009, we had a total of $2.5

billion in cash withdrawals offsetting our $2.5 billion in Aggregate Cash Deposits held within the same financial

institution under this cash pooling arrangement.

Note 9 — Derivative Instruments:

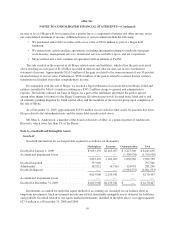

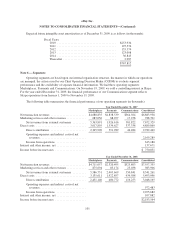

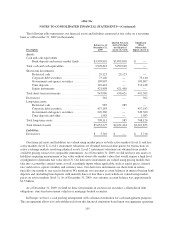

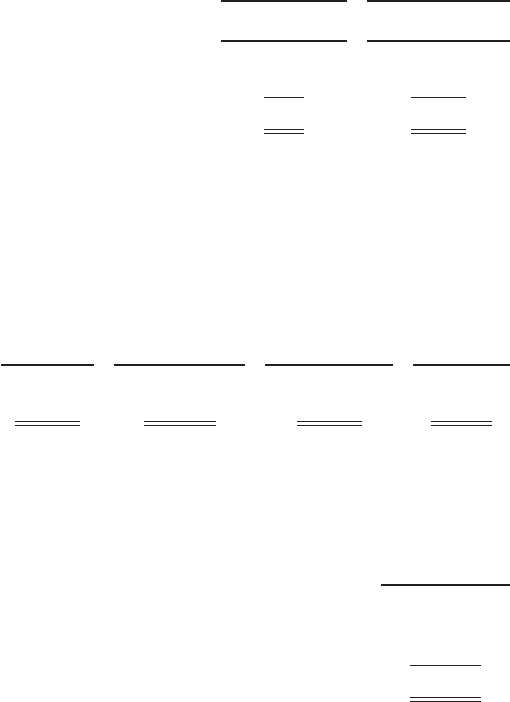

Fair Value of Derivative Contracts: Derivative instruments are reported at fair value as follows (in

thousands):

Derivative Assets

Reported in Other

Current Assets

Derivative Liabilities

Reported in Other

Current Liabilities

December 31,

2009

December 31,

2009

Foreign exchange contracts designated as cash flow hedges ............ $ 27 $4,848

Foreign exchange contracts not designated as hedging instruments ....... 335 862

Total fair value of derivative instruments ........................... $362 $5,710

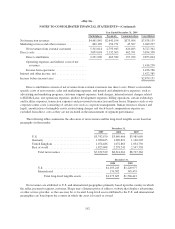

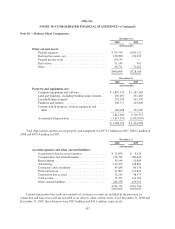

Effect of Derivative Contracts on Accumulated Other Comprehensive Income (Loss): The following table

represents the activity of derivative contracts which qualify for hedge accounting as of December 31, 2008 and

December 31, 2009, and the impact of designated derivative contracts on accumulated other comprehensive

income for year ended December 31, 2009 (in thousands):

December 31,

2008

Gain (loss)

recognized in other

comprehensive

income

Gain (loss)

reclassified from

accumulated other

comprehensive

income to income

December 31,

2009

Foreign exchange contracts designated as cash

flow hedges .......................... $40,352 $(60,603) $15,430 $(4,821)

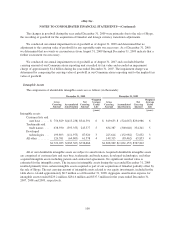

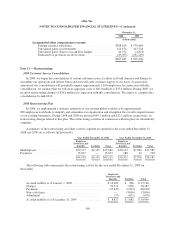

Effect of Derivative Contracts on the Consolidated Statement of Income: The following table provides the

location in our financial statements of the recognized gains or losses related to our derivative instruments (in

thousands):

Year Ended

December 31, 2009

Foreign exchange contracts designated as cash flow hedges recognized in net revenues ...... $15,430

Foreign exchanges contracts not designated as hedging instruments recognized in interest and

other income, net ............................................................ (28,933)

Total gain recognized from derivative contracts in the consolidated statement of income ..... $(13,503)

106