eBay 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

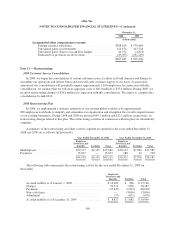

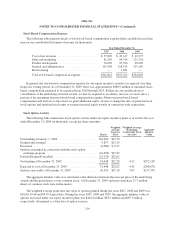

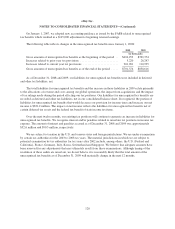

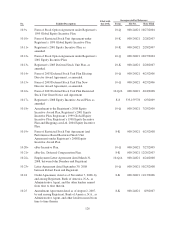

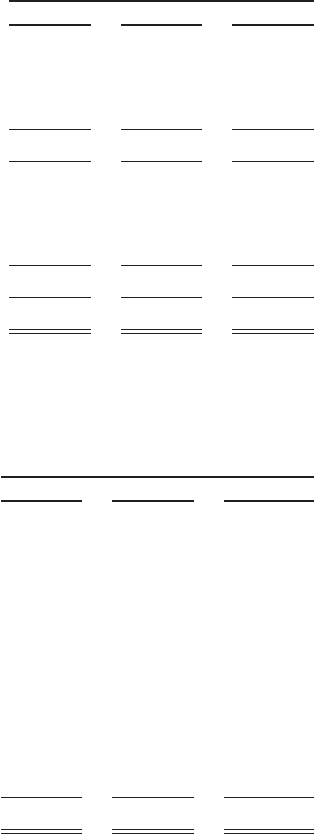

The provision for income taxes is composed of the following (in thousands):

Year Ended December 31,

2007 2008 2009

Current:

Federal ............................... $402,235 $ 414,301 $ 507,411

State and local ......................... 38,087 94,763 96,496

Foreign ............................... 85,649 101,662 64,960

525,971 610,726 668,867

Deferred:

Federal ............................... (81,745) (148,094) (160,811)

State and local ......................... (13,976) (21,109) (20,179)

Foreign ............................... (27,650) (37,433) 2,177

(123,371) (206,636) (178,813)

$ 402,600 $ 404,090 $ 490,054

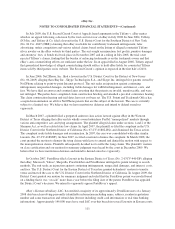

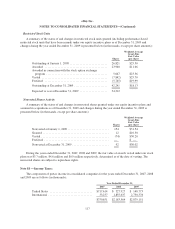

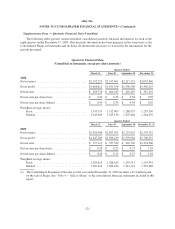

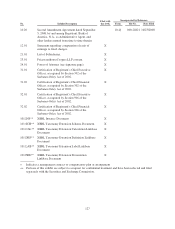

The following is a reconciliation of the difference between the actual provision for income taxes and the

provision computed by applying the federal statutory rate of 35% for 2007, 2008 and 2009 to income before

income taxes (in thousands):

Year Ended December 31,

2007 2008 2009

Provision at statutory rate .................... $262,798 $ 764,248 $1,007,703

Permanent differences:

Foreign income taxed at different rates ..... (404,007) (519,203) (475,967)

Goodwill impairment ................... 486,828 — —

Gain on sale of Skype ................... — — (498,360)

Joltid settlement ....................... — — 120,339

Legal entity restructuring ................ — — 184,410

Change in valuation allowance ............ 34,983 48,614 58,670

Stock-based compensation ............... 24,516 26,730 41,436

State taxes, net of federal benefit .......... 15,672 54,356 49,606

Tax credits ........................... (7,766) (9,251) (13,352)

Other ................................ (10,424) 38,596 15,569

$ 402,600 $ 404,090 $ 490,054

In November 2009, we completed a legal entity restructuring to align our corporate structure with our

organizational objectives. The tax impact of this restructuring resulted in U.S. federal income taxes of

$184.4 million and state income taxes of $23.0 million, which are included in the 2009 tax expense.

118