eBay 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

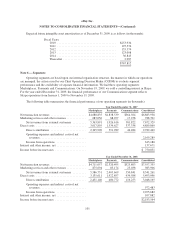

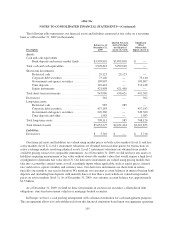

Expected future intangible asset amortization as of December 31, 2009 is as follows (in thousands):

Fiscal Years:

2010 ........................................ $253,934

2011 ........................................ 195,576

2012 ........................................ 155,374

2013 ........................................ 123,098

2014 ........................................ 36,843

Thereafter .................................... 2,987

$767,812

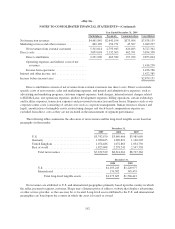

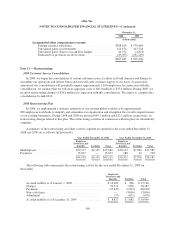

Note 6 — Segments:

Operating segments are based upon our internal organization structure, the manner in which our operations

are managed, the criteria used by our Chief Operating Decision Maker (CODM) to evaluate segment

performance and the availability of separate financial information. We had three operating segments:

Marketplaces, Payments and Communications. On November 19, 2009, we sold a controlling interest in Skype.

For the year ended December 31, 2009, the financial performance of our Communications segment reflects

Skype operations from January 1, 2009 to November 19, 2009.

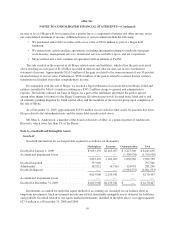

The following table summarizes the financial performance of our operating segments (in thousands):

Year Ended December 31, 2007

Marketplaces Payments Communications Consolidated

Net transaction revenues ........................ $4,680,835 $1,838,539 $364,564 $6,883,938

Marketing services and other revenues ............. 683,056 88,077 17,258 788,391

Net revenues from external customers ......... 5,363,891 1,926,616 381,822 7,672,329

Direct costs .................................. 3,017,895 1,534,627 337,338 4,889,860

Direct contribution ........................ 2,345,996 391,989 44,484 2,782,469

Operating expenses and indirect costs of net

revenues ............................... 2,169,289

Income from operations .................... 613,180

Interest and other income, net .................... 137,671

Income before income taxes ..................... $ 750,851

Year Ended December 31, 2008

Marketplaces Payments Communications Consolidated

Net transaction revenues ........................ $4,711,057 $2,320,495 $525,803 $7,557,355

Marketing services and other revenues ............. 875,694 83,174 25,038 983,906

Net revenues from external customers ......... 5,586,751 2,403,669 550,841 8,541,261

Direct costs .................................. 3,135,611 1,922,897 434,588 5,493,096

Direct contribution ........................ 2,451,140 480,772 116,253 3,048,165

Operating expenses and indirect costs of net

revenues ............................... 972,483

Income from operations .................... 2,075,682

Interest and other income, net .................... 107,882

Income before income taxes ..................... $2,183,564

101