eBay 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

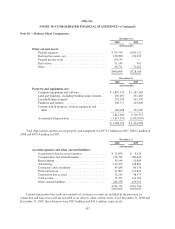

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

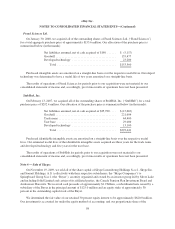

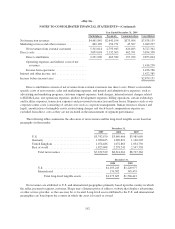

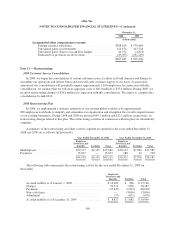

Fraud Sciences Ltd.

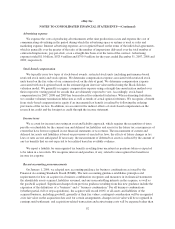

On January 30, 2008, we acquired all of the outstanding shares of Fraud Sciences Ltd. (“Fraud Sciences”)

for a total aggregate purchase price of approximately $153.6 million. Our allocation of the purchase price is

summarized below (in thousands):

Net liabilities assumed, net of cash acquired of $198 ...... $ (5,117)

Goodwill ......................................... 135,477

Developed technology .............................. 23,200

Total ........................................ $153,560

Purchased intangible assets are amortized on a straight-line basis over the respective useful lives. Developed

technology was determined to have a useful life of two years amortized on a straight-line basis.

The results of operations of Fraud Sciences for periods prior to our acquisition were not material to our

consolidated statement of income and, accordingly, pro forma results of operations have not been presented.

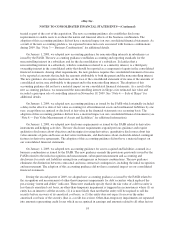

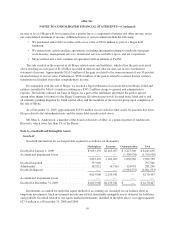

StubHub, Inc.

On February 13, 2007, we acquired all of the outstanding shares of StubHub, Inc. (“StubHub”) for a total

purchase price of $292.4 million. Our allocation of the purchase price is summarized below (in thousands):

Net liabilities assumed, net of cash acquired of $25,780 .... $(15,663)

Goodwill ......................................... 221,604

Trade name ....................................... 44,400

User base ........................................ 29,000

Developed technology .............................. 13,100

Total ........................................ $292,441

Purchased identifiable intangible assets are amortized on a straight-line basis over the respective useful

lives. Our estimated useful lives of the identifiable intangible assets acquired are three years for the trade name

and developed technology and five years for the user base.

The results of operations of StubHub for periods prior to our acquisition were not material to our

consolidated statement of income and, accordingly, pro forma results of operations have not been presented.

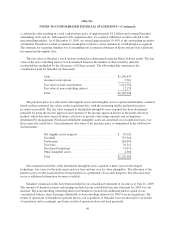

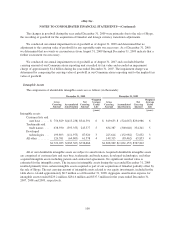

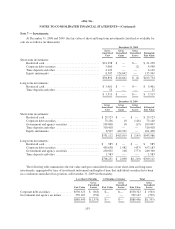

Note 4 — Sale of Skype:

On November 19, 2009, we sold all of the share capital of Skype Luxembourg Holdings S.a.r.l., Skype Inc.

and Sonorit Holdings, A.S. (collectively with their respective subsidiaries, the “Skype Companies”) to

Springboard Group S.à.r.l. (the “Buyer”), an entity organized and owned by an investor group led by Silver Lake

and including Joltid Limited and certain of its affiliated parties, the Canada Pension Plan Investment Board and

Andreessen Horowitz. We received cash proceeds of approximately $1.9 billion, a subordinated note issued by a

subsidiary of the Buyer in the principal amount of $125.0 million and an equity stake of approximately 30

percent in the outstanding capital stock of the Buyer.

We determined the fair value of our retained 30 percent equity interest to be approximately $620.0 million.

Our investment is accounted for under the equity method of accounting, and our proportionate share of the

98