eBay 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

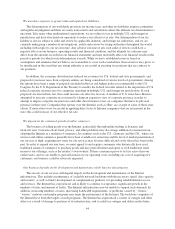

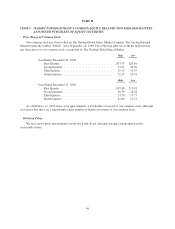

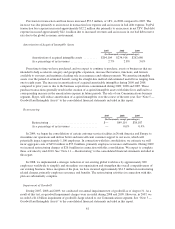

ITEM 6: SELECTED FINANCIAL DATA

The following selected consolidated financial data should be read in conjunction with the consolidated

financial statements and notes thereto and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” appearing elsewhere in this Annual Report on Form 10-K. The consolidated statement of

income and the consolidated balance sheet data for the years ended, and as of, December 31, 2005, 2006, 2007,

2008 and 2009 are derived from our audited consolidated financial statements.

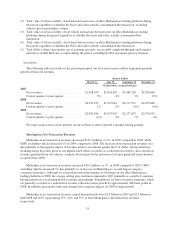

Year Ended December 31,

2005 2006 (2) 2007 (2)(3) 2008 (2) 2009 (2)(4)

(In thousands, except per share amounts)

Consolidated Statement of Income Data (1):

Net revenues ............................ $4,552,401 $5,969,741 $7,672,329 $8,541,261 $8,727,362

Gross profit ............................. 3,734,297 4,712,949 5,909,357 6,313,192 6,247,600

Income from operations ................... 1,441,707 1,422,956 613,180 2,075,682 1,456,766

Income before income taxes ................ 1,549,328 1,547,057 750,851 2,183,564 2,879,151

Net income ............................. 1,082,043 1,125,639 348,251 1,779,474 2,389,097

Net income per share:

Basic .............................. $ 0.79 $ 0.80 $ 0.26 $ 1.37 $ 1.85

Diluted ............................. $ 0.78 $ 0.79 $ 0.25 $ 1.36 $ 1.83

Weighted average shares:

Basic .............................. 1,361,708 1,399,251 1,358,797 1,303,454 1,289,848

Diluted ............................. 1,393,875 1,425,472 1,376,174 1,312,608 1,304,981

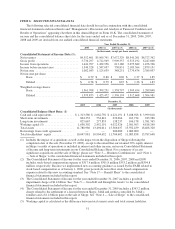

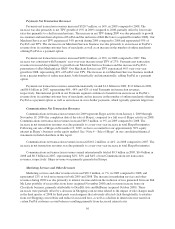

December 31,

2005 2006 2007 2008 2009

(In thousands)

Consolidated Balance Sheet Data: (1)

Cash and cash equivalents ............... $ 1,313,580 $ 2,662,792 $ 4,221,191 $ 3,188,928 $ 3,999,818

Short-term investments ................. 804,352 554,841 676,264 163,734 943,986

Long-term investments ................. 825,667 277,853 138,237 106,178 1,381,765

Working capital (5) .................... 1,698,302 2,452,191 4,022,926 2,581,503 4,818,240

Total assets .......................... 11,788,986 13,494,011 15,366,037 15,592,439 18,408,320

Borrowings from credit agreement ........ — — 200,000 1,000,000 —

Total stockholders’ equity ............... 10,047,981 10,904,632 11,704,602 11,083,858 13,787,648

(1) Includes the impact of acquisitions as well as the impact from the disposition of Skype following the

completion date of the sale (November 19, 2009), except to the extent that our retained 30% equity interest

in Skype’s results of operations is included in interest and other income, net in our Consolidated Statement

of Income and long-term investments in our Consolidated Balance Sheet. For a summary of recent

significant acquisitions and the sale of Skype, please see “Note 3 — Business Combinations” and “Note 4

— Sale of Skype” to the consolidated financial statements included in this report.

(2) The Consolidated Statement of Income for the years ended December 31, 2006, 2007, 2008 and 2009

includes stock-based compensation expense of $317.4 million, $301.8 million $353.2 million and $394.8

million, respectively. Because we implemented new accounting guidance as issued by the FASB related to

stock based compensation as of January 1, 2006, prior periods do not reflect stock-based compensation

expense related to this new accounting standard. See “Note 17 — Benefit Plans” to the consolidated

financial statements included in this report.

(3) The Consolidated Statement of Income for the year ended December 31, 2007 includes a goodwill

impairment charge of $1.4 billion. See “Note 5 — Goodwill and Intangibles Assets” to the consolidated

financial statements included in this report.

(4) The Consolidated Statement of Income for the year ended December 31, 2009 includes a $343.2 million

charge related to the settlement of a lawsuit between Skype, Joltid and entities controlled by Joltid’s

founders and a $1.4 billion gain on the sale of Skype. See “Note 4 — Sale of Skype” to the consolidated

financial statements included in this report.

(5) Working capital is calculated as the difference between total current assets and total current liabilities.

51