eBay 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

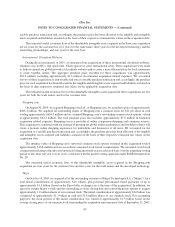

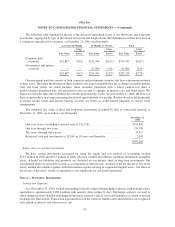

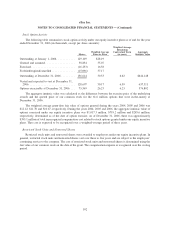

Translation Exposure

We consolidate the earnings of our international subsidiaries by converting them into U.S. dollars in

accordance with Financial Accounting Standards No. 52 “Foreign Currency Translation” (FAS 52). Such earnings

will fluctuate when there is a change in foreign currency exchange rates. We enter into transactions to hedge

portions of our foreign currency denominated earnings translation exposure using either forward exchange

contracts or other instruments. All contracts that hedge translation exposure mature ratably over the quarter in

which they are executed. During the years ended December 31, 2005 and 2006, the realized gains and losses related

to these hedges were not significant.

Economic Exposure

We currently charge our international subsidiaries on a monthly basis for their use of intellectual property and

technology and for certain corporate services provided by eBay and by PayPal. These charges are denominated in

Euros and these forecasted inter-company transactions represent a foreign currency cash flow exposure. To reduce

foreign exchange risk relating to these forecasted inter-company transactions, we entered into forward foreign

exchange contracts during the year ended December 31, 2006. The objective of the forward contracts is to better

ensure that the U.S. dollar-equivalent cash flows are not adversely affected by changes in the U.S. dollar/Euro

exchange rate. Pursuant to Financial Accounting Standards No. 133 “Accounting for Derivative Instruments and

Hedging Activities” (FAS 133), we expect the hedge of certain of these forecasted transactions to be highly effective

in offsetting potential changes in cash flows attributed to a change in the U.S. dollar/Euro exchange rate.

Accordingly, we record as a component of accumulated other comprehensive income all unrealized gains and

losses related to the forward contracts that receive hedge accounting treatment. We record all unrealized gains and

losses in interest and other income, net, related to the forward contracts that do not receive hedge accounting

treatment pursuant to FAS 133. During the years ended December 31, 2005 and 2006, the realized gains and losses

related to these hedges were not significant. The notional amount of our economic hedges receiving hedge

accounting treatment and the losses, net of gains, recorded to accumulated other comprehensive income as of

December 31, 2005 was $203 million and $200,000, respectively. We did not have any economic hedges in place as

of December 31, 2006.

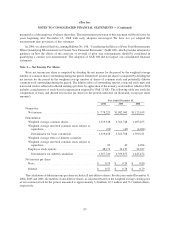

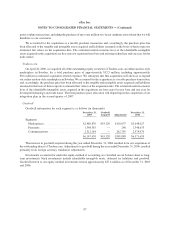

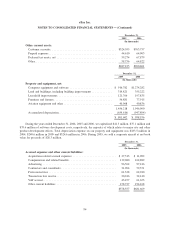

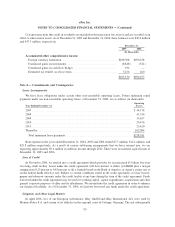

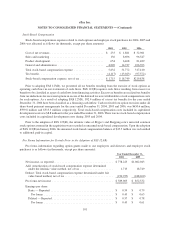

Note 7 — Balance Sheet Components:

2005 2006

December 31,

(In thousands)

Accounts receivable, net:

Accounts receivable ......................................... $396,373 $476,060

Allowance for doubtful accounts ............................. (62,507) (68,401)

Allowance for authorized credits ............................. (11,078) (14,464)

$322,788 $393,195

93

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)