eBay 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock-based compensation expense recognized during the period is based on the value of the portion of stock-

based payment awards that is ultimately expected to vest. Stock-based compensation expense recognized in the

consolidated statement of income during 2006 included compensation expense for stock-based payment awards

granted prior to, but not yet vested as of, January 1, 2006 based on the grant date fair value estimated in accordance

with the pro forma provisions of FAS No. 148, “Accounting for Stock-Based Compensation — Transition and

Disclosures” (FAS 148) and compensation expense for the stock-based payment awards granted subsequent to

December 31, 2005, based on the grant date fair value estimated in accordance with FAS 123(R). As stock-based

compensation expense recognized in the statement of income for 2006 is based on awards ultimately expected to

vest, it has been reduced for estimated forfeitures. FAS 123(R) requires forfeitures to be estimated at the time of

grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. In the pro

forma information required under FAS 148 for the periods prior to 2006, we accounted for forfeitures as they

occurred.

FAS No. 123(R) prohibits recognition of a deferred tax asset for an excess tax benefit that has not been

realized. We will recognize a benefit from stock-based compensation in equity if an incremental tax benefit is

realized by following the ordering provisions of the tax law. In addition, we account for the indirect effects of stock-

based compensation on the research tax credit and the foreign tax credit through the income statement.

Income taxes

We account for income taxes using an asset and liability approach, which requires the recognition of taxes

payable or refundable for the current year and deferred tax liabilities and assets for the future tax consequences of

events that have been recognized in our financial statements or tax returns. The measurement of current and

deferred tax assets and liabilities is based on provisions of enacted tax laws; the effects of future changes in tax laws

or rates are not anticipated. If necessary, the measurement of deferred tax assets is reduced by the amount of any tax

benefits that are not expected to be realized based on available evidence.

Recent accounting pronouncements

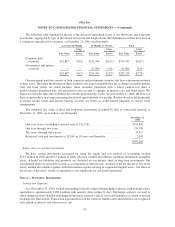

In July 2006, the Financial Accounting Standards Board (“FASB”) issued Financial Interpretation No. 48,

“Accounting for Uncertainty in Income Taxes — an interpretation of FASB Statement No. 109” (“FIN 48”), which

is a change in accounting for income taxes. Among other provisions, FIN 48 specifies how tax benefits for uncertain

tax positions are to be recognized, measured, and derecognized in financial statements; requires certain disclosures

of uncertain tax matters; specifies how reserves for uncertain tax positions should be classified on the balance sheet;

and provides transition and interim-period guidance. FIN 48 is effective for fiscal years beginning after Decem-

ber 15, 2006 and as a result, is effective for us in the first quarter of 2007. We have not yet completed our evaluation

of the impact of adoption on our consolidated financial statements.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (FAS 157). FAS 157

establishes a framework for measuring fair value and expands disclosures about fair value measurements. The

changes to current practice resulting from the application of this Statement relate to the definition of fair value, the

methods used to measure fair value, and the expanded disclosures about fair value measurements. We will be

required to adopt the provisions on FAS 157 beginning with our first quarter ending March 31, 2007. We do not

believe that the adoption of the provisions of FAS 157 will materially impact our consolidated financial statements.

Effective December 31, 2006 we adopted the recognition and disclosure provisions of SFAS No. 158,

“Employers Accounting for Defined Benefit Pension and Other Postretirement Plans — an amendment of FASB

Statements No. 87, 88, 106, and 132(R),” (FAS 158). These provisions did not materially impact our consolidated

financial statements. FAS 158 requires an employer to recognize the over-funded or under-funded status of a

defined benefit pension and other postretirement plan (other than a multiemployer plan) as an asset or liability in its

statement of financial position and to recognize changes in that funded status in the year in which the changes occur

through comprehensive income of a business entity. This statement also requires plan assets and obligations to be

82

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)