eBay 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

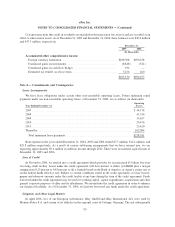

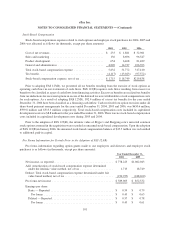

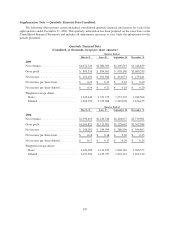

The following is a reconciliation of the difference between the actual provision for income taxes and the

provision computed by applying the federal statutory rate of 35% for 2004, 2005, and 2006 to income before income

taxes (in thousands):

2004 2005 2006

Year Ended December 31,

Provision at statutory rate ........................... $394,881 $ 542,282 $ 541,471

Permanent differences:

Foreign income taxed at different rates ................ (82,267) (149,463) (230,350)

Change in valuation allowance ...................... 2,000 12,587 35,652

Stock-based compensation ......................... 26,179

State taxes, net of federal benefit .................... 35,008 53,697 58,542

Tax credits ..................................... (6,975) (9,136) (1,142)

Other . . ....................................... 1,238 17,318 (8,934)

$343,885 $ 467,285 $ 421,418

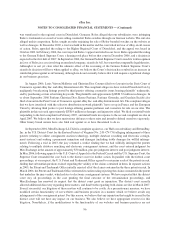

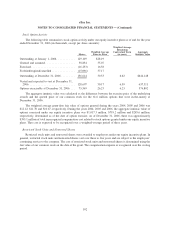

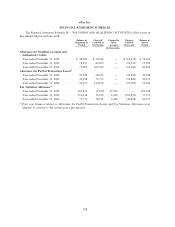

Deferred tax assets and liabilities are recognized for the future tax consequences of differences between the

carrying amounts of assets and liabilities and their respective tax bases using enacted tax rates in effect for the year

in which the differences are expected to reverse. Significant deferred tax assets and liabilities consist of the

following (in thousands):

2005 2006

December 31,

Deferred tax assets:

Net operating loss and credits ................................ $132,832 $ 111,133

Accruals, allowances and stock-based compensation ................ 71,504 192,276

Net unrealized (gains) losses ................................. 9,616 4,024

Net deferred tax assets . . ................................... 213,952 307,433

Valuation allowance ....................................... (77,712) (69,777)

136,240 237,656

Deferred tax liabilities:

Acquisition-related intangibles ................................ (212,702) (171,422)

Depreciation and amortization ................................ (79,946) (30,139)

(292,648) (201,561)

$(156,408) $ 36,095

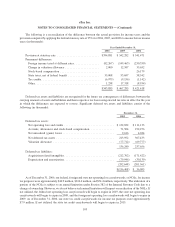

As of December 31, 2006, our federal, foreign and state net operating loss carryforwards, or NOLs, for income

tax purposes were approximately $44.9 million, $324.6 million, and $54.4 million, respectively. The utilization of a

portion of the NOLs is subject to an annual limitation under Section 382 of the Internal Revenue Code due to a

change of ownership. However, we do not believe such annual limitation will impact our realization of the NOLs. If

not utilized, the federal net operating loss carryforwards will begin to expire in 2019, the state net operating loss

carryforwards will begin to expire in 2009, and the foreign net operating loss carryforwards will begin to expire in

2009. As of December 31, 2006, our state tax credit carryforwards for income tax purposes were approximately

$7.9 million. If not utilized, the state tax credit carryforwards will begin to expire in 2015.

105

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)