eBay 2006 Annual Report Download - page 110

Download and view the complete annual report

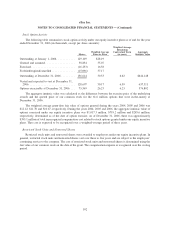

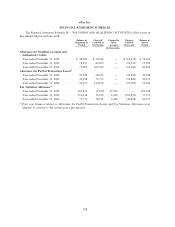

Please find page 110 of the 2006 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We receive tax deductions from the gains realized by employees on the exercise of certain non-qualified stock

options for which the benefit is recognized as a component of stockholders’ equity. Historically, we have evaluated

the deferred tax assets relating to these stock option deductions along with our other deferred tax assets and

concluded that a valuation allowance is not required for that portion of the total deferred tax assets that are not

considered more likely than not to be realized in future periods. To the extent that the deferred tax assets with a

valuation allowance become realizable in future periods, we will have the ability, subject to carryforward

limitations, to benefit from these amounts. When realized, the tax benefits of tax deductions related to stock

options are accounted for as an increase to additional paid-in capital rather than a reduction of the income tax

provision. Our profitability coupled with the level of stock option deductions generated during 2006 resulted in the

utilization of net operating losses related to deferred tax assets for stock option deductions. Accordingly the

valuation allowance related to these deferred tax assets was eliminated in 2006, resulting in an increase of

$42.9 million in additional paid-in capital. Beginning in 2006, deferred tax assets related to stock option deductions

were recognized in the periods when the benefit was received.

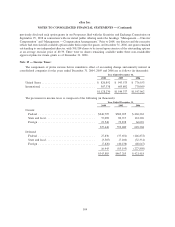

We have not provided for U.S. federal income and foreign withholding taxes on $1.9 billion of non-U.S. sub-

sidiaries’ undistributed earnings as of December 31, 2006, because such earnings are intended to be indefinitely

reinvested in the operations and potential acquisitions of our International operations. Upon distribution of those

earnings in the form of dividends or otherwise, we would be subject to U.S. income taxes (subject to an adjustment

for foreign tax credits). It is not practicable to determine the income tax liability that might be incurred if these

earnings were to be distributed.

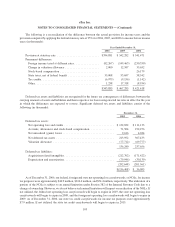

Note 14 — Subsequent Events:

During January 2007, eBay’s Board of Director’s authorized the expansion of the share repurchase program to

provide for the repurchase of up to an additional $2.0 billion of eBay’s common stock within the next two years. See

discussion of our stock repurchase program at “Note 11 — Common Stock.”

On February 13, 2007, we completed the acquisition of StubHub, an online marketplace for the resale of event

tickets, for a total purchase price of approximately $307 million, which included StubHub’s net cash at the time of

closing of $21 million. Under the purchase method of accounting, the total purchase price will be allocated to the

tangible and identifiable intangible assets acquired and liabilities assumed based on their estimated fair values.

106

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)