eBay 2006 Annual Report Download - page 85

Download and view the complete annual report

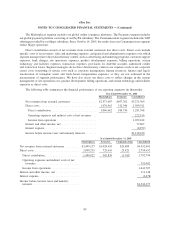

Please find page 85 of the 2006 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.at the end of a period or collection of the resulting account receivable is not considered probable, revenues are

deferred until the obligation is satisfied or the uncertainty is resolved. These amounts are included in deferred

revenues in our consolidated balance sheet. Revenue from barter arrangements totaled $13.3 million, $6.7 million

and $1.4 million for the years ended December 31, 2004, 2005 and 2006, respectively, with the reciprocal

arrangements being recognized as an operating expense. In general, the services are received in the same period in

which the reciprocal services are provided. In certain circumstances, we are required to record, as a reduction of

revenue, payments to a party who is also a customer. These payments primarily consist of certain promotional

activities which result in payments to our users.

Our other revenues are derived principally from contractual arrangements with third parties that provide

transaction services to eBay and PayPal users and interest earned from banks on certain PayPal customer account

balances. Revenues from contractual arrangements with third parties are recognized as the contracted services are

delivered to end users. Revenues from interest income are recognized when earned.

We evaluate whether payments made to customers or revenues earned from vendors have a separate

identifiable benefit and whether they are fairly valued in determining the appropriate classification of the related

revenues and expense. For revenue agreements with multiple deliverables we ensure all undelivered elements are

accounted for at fair value.

Provisions for doubtful accounts, transaction losses and authorized credits are made at the time of revenue

recognition based upon our historical experience. The provision for doubtful accounts and transaction losses are

recorded as charges to operating expense, while the provision for authorized credits is recognized as a reduction of

net revenues.

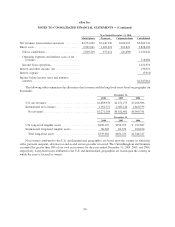

Product development costs

Costs related to the planning and post implementation phases of our website development efforts are recorded

as an operating expense. Direct costs incurred in the development phase are capitalized and amortized over the

product’s estimated useful life of one to three years as charges to cost of net revenues.

Advertising expense

We expense the costs of producing advertisements at the time production occurs and expense the cost of

communicating advertising in the period during which the advertising space or airtime is used. Internet advertising

expenses are recognized based on the terms of the individual agreements, which is generally over the greater of the

ratio of the number of impressions delivered over the total number of contracted impressions, pay-per-click, or on a

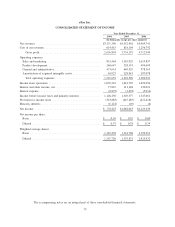

straight-line basis over the term of the contract. Advertising expenses totaled $459.5 million, $665.1 million and

$871.0 million during the years ended December 31, 2004, 2005, and 2006, respectively.

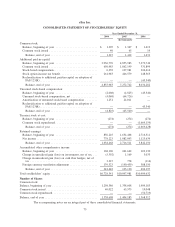

Stock-based compensation

On January 1, 2006, we adopted Statement of Financial Accounting Standards (“SFAS”) No. 123 (revised

2004), “Share-Based Payment” (FAS 123(R)), which requires companies to recognize in the statement of operations

all share-based payments to employees, including grants of employee stock options, based on their fair value. The

statement eliminates the ability to account for share-based compensation transactions, as we formerly did, using the

intrinsic value method as prescribed by Accounting Principles Board, or APB, Opinion No. 25, “Accounting for

Stock Issued to Employees.”

We adopted FAS 123(R) using the modified prospective method, which requires the application of the

accounting standard as of January 1, 2006. Our consolidated financial statements as of and for the year ended

December 31, 2006 reflect the impact of adopting FAS 123(R). In accordance with the modified prospective

method, the consolidated financial statements for prior periods have not been restated to reflect, and do not include,

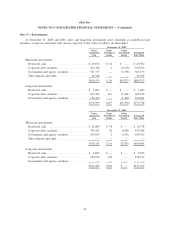

the impact of FAS 123(R). See “Note 12 — Stock-Based Plans” for further details.

81

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)