eBay 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

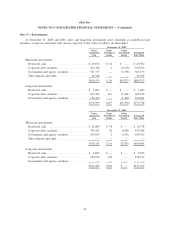

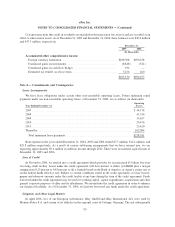

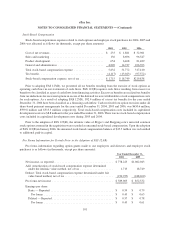

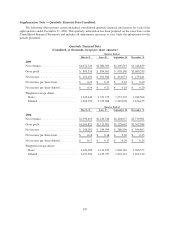

Stock-Based Compensation

Stock-based compensation expense related to stock options and employee stock purchases for 2004, 2005 and

2006 was allocated as follows (in thousands, except per share amounts):

2004 2005 2006

Cost of net revenues .................................. $ 233 $ 1,881 $ 32,981

Sales and marketing .................................. 136 8,696 96,547

Product development .................................. 654 6,468 81,489

General and administrative ............................. 4,809 14,727 106,393

Total stock-based compensation expense ................... 5,832 31,772 317,410

Tax benefit ......................................... (4,117) (13,023) (97,572)

Stock-based compensation expense, net of tax ............... $1,715 $ 18,749 $219,838

Prior to adopting FAS 123(R), we presented all tax benefits resulting from the exercise of stock options as

operating cash flows in our statements of cash flows. FAS 123(R) requires cash flows resulting from excess tax

benefits to be classified as a part of cash flows from financing activities. Excess tax benefits are realized tax benefits

from tax deductions for exercised options in excess of the deferred tax asset attributable to stock compensation costs

for such options. As a result of adopting FAS 123(R), $92.4 million of excess tax benefits for the year ended

December 31, 2006 have been classified as a financing cash inflow. Cash received from option exercises under all

share-based payment arrangements for the years ended December 31, 2004, 2005 and 2006, was $650.6 million,

$599.8 million and $313.5 million, respectively. Total stock-based compensation costs included in capitalized

development costs was $8.8 million for the year ended December 31, 2006. There was no stock-based compensation

costs included in capitalized development costs during 2005 and 2004.

Prior to the adoption of FAS 123(R), the intrinsic value of Skype’s and Shopping.com’s unvested common

stock options assumed in the acquisition were recorded as unearned stock-based compensation. Upon the adoption

of FAS 123(R) in January 2006, the unearned stock-based compensation balance of $45.5 million was reclassified

to additional paid-in capital.

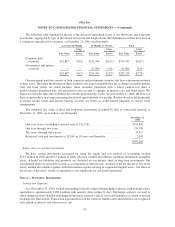

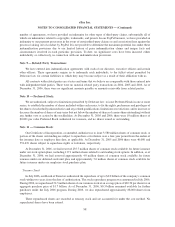

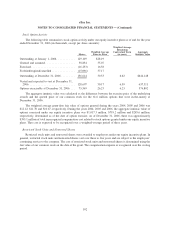

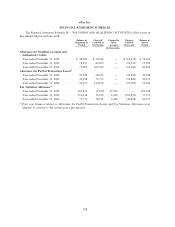

Pro Forma Information for Periods Prior to the Adoption of FAS 123(R)

Pro forma information regarding option grants made to our employees and directors and employee stock

purchases is as follows (in thousands, except per share amounts):

2004 2005

Year Ended December 31,

Net income, as reported ...................................... $778,223 $1,082,043

Add: Amortization of stock-based compensation expense determined

under the intrinsic value method, net of tax ..................... 1,715 18,749

Deduct: Total stock-based compensation expense determined under fair

value based method, net of tax ............................... (190,935) (248,260)

Pro forma net income ....................................... $589,003 $ 852,532

Earnings per share:

Basic — Reported ........................................ $ 0.59 $ 0.79

Pro forma ............................................ $ 0.45 $ 0.63

Diluted — Reported ....................................... $ 0.57 $ 0.78

Pro forma ............................................ $ 0.43 $ 0.61

101

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)