eBay 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

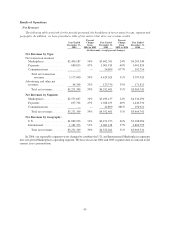

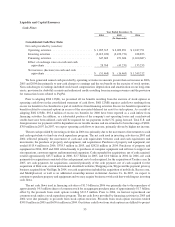

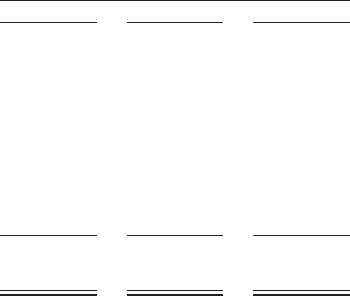

Liquidity and Capital Resources

Cash Flows

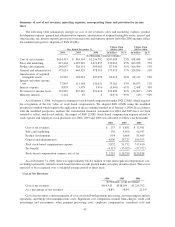

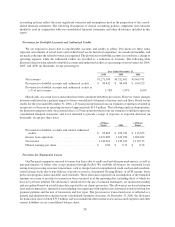

2004 2005 2006

Year Ended December 31,

(In thousands)

Consolidated Cash Flow Data:

Net cash provided by (used in):

Operating activities .......................... $1,285,315 $ 2,009,891 $ 2,247,791

Investing activities .......................... (2,013,220) (2,452,731) 228,853

Financing activities .......................... 647,669 471,606 (1,260,687)

Effect of exchange rates on cash and cash

equivalents .............................. 28,768 (45,231) 133,255

Net increase (decrease) in cash and cash

equivalents .............................. $ (51,468) $ (16,465) $ 1,349,212

We have generated annual cash provided by operating activities in amounts greater than net income in 2006,

2005 and 2004 due primarily to non-cash charges to earnings and the tax benefit on the exercise of stock options.

Non-cash charges to earnings included stock-based compensation, depreciation and amortization on our long-term

assets, provision for doubtful accounts and authorized credits resulting from increasing revenues and the provision

for transaction losses related to PayPal.

Prior to adopting FAS 123(R), we presented all tax benefits resulting from the exercise of stock options as

operating cash flows in the consolidated statement of cash flows. FAS 123(R) requires cash flows resulting from

excess tax benefits to be classified as a part of cash flows from financing activities. Excess tax benefits represent tax

benefits related to exercised options in excess of the associated deferred tax asset for such options. As a result of

adopting FAS 123(R), $92.4 million of excess tax benefits for 2006 have been reported as a cash inflow from

financing activities. In addition, as a substantial portion of the company’s net operating losses and carryforward

credits have now been utilized, cash will be required for tax payments in the U.S. going forward. Total U.S. and

foreign income tax payments will be dependent on our taxable income and are estimated to be in the range of $650-

$700 million in 2007. In 2007, we expect operating cash flows to increase, primarily driven by higher net income.

The net cash provided by investing activities in 2006 was primarily due to the movement of investments to cash

and cash equivalents to fund our stock repurchase program. The net cash used in investing activities in 2005 and

2004 reflected primarily the movement of cash and cash equivalents between cash and cash equivalents and

investments, the purchase of property and equipment, and acquisitions. Purchases of property and equipment, net

totaled $515.4 million in 2006, $338.3 million in 2005, and $292.8 million in 2004. Purchases of property and

equipment in 2006, 2005 and 2004 related mainly to purchases of computer equipment and software to support our

site operations, customer support and international expansion. Cash expended for acquisitions, net of cash acquired,

totaled approximately $45.5 million in 2006, $2.7 billion in 2005, and $1.0 billion in 2004. In 2006, net cash

payments for acquisitions consisted of the cash payment, net of cash acquired, for the acquisition of Tradera.com. In

2005, net cash payments for acquisitions consisted primarily of the cash payment, net of cash acquired for the

acquisition of Rent.com, certain international classifieds websites, Shopping.com, Skype and the payment gateway

business acquired from VeriSign. In 2004, our cash acquisitions included the acquisition of mobile.de, Baazee.com,

and Marktplaats.nl, as well as an additional ownership interest in Internet Auction Co. In 2007, we expect to

continue to purchase property and equipment and we may acquire businesses with cash that would impact investing

cash flows.

The net cash flows used in financing activities of $1.3 billion in 2006 was primarily due to the repurchase of

approximately 54.5 million shares of common stock for an aggregate purchase price of approximately $1.7 billion,

offset by the proceeds from stock options totaling $313.5 million. Prior to 2006, we had not repurchased our

common stock under a stock repurchase program. The net cash flows provided by financing activities in 2005 and

2004 were due primarily to proceeds from stock option exercises. Proceeds from stock option exercises totaled

$599.8 million in 2005 and $650.6 million in 2004. Our future cash flows from stock options are difficult to project

55