eBay 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

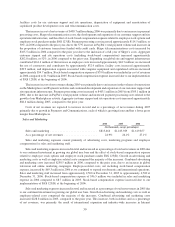

due to our stock repurchase activity in 2006. The weighted-average interest rate of our portfolio increased to 3.8% in

2006 from 2.9% in 2005.

Our interest and other income, net increased in total and remained consistent as a percentage of net revenues

during 2005 as compared to the prior year, primarily as a result of increased interest income due to increased cash,

cash equivalents and investments balances and higher interest rates. The weighted-average interest rate of our

portfolio increased to 2.9% in 2005 from 1.7% in 2004.

We expect that interest and other income, net, will decline slightly during 2007 compared to 2006, as a result of

lower cash balances due to our stock repurchase program. Our expectation for interest and other income, net, for

2007 excludes the potential effects from any future acquisitions we may make.

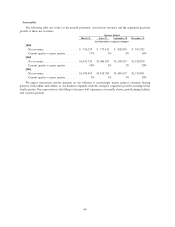

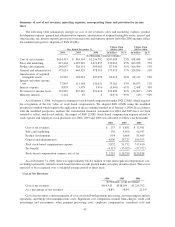

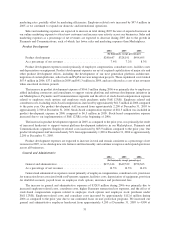

Interest Expense

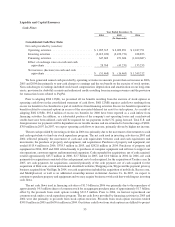

2004 2005 2006

(In thousands, except percentages)

Interest expense ...................................... $8,879 $3,478 $5,916

As a percentage of net revenues .......................... 0.3% 0.1% 0.1%

Interest expense consists of interest charges on tax contingencies, legal accruals, capital leases and our

consolidated lease arrangement related to our San Jose headquarters office facilities. In 2007, interest expense may

be impacted by our decision to utilize our line of credit. See additional discussion of our line of credit in “Note 8 —

Commitments and Contingencies” to our consolidated financial statements included elsewhere in this Annual

Report on Form 10-K.

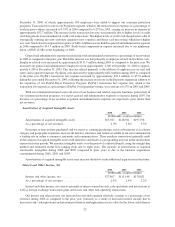

Provision for Income Taxes

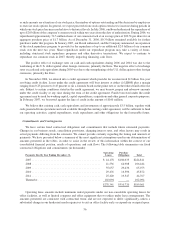

2004 2005 2006

(In thousands, except percentages)

Provision for income taxes ............................ $343,885 $467,285 $421,418

As a percentage of net revenues ........................ 10.5% 10.3% 7.1%

Effective tax rate ................................... 30% 30% 27%

The provision for income taxes differs from the amount computed by applying the statutory U.S. federal rate

principally due to state taxes, subsidiary losses for which we have not provided a benefit and other factors that

increase the effective tax rate, offset by decreases resulting from foreign income with lower effective tax rates and

tax credits.

The lower effective tax rates in 2006 as compared to 2005 and 2004 resulted primarily from the expansion of

our international businesses and from changes in our operations in international markets. We expect the effective tax

rate for 2007 to be consistent with 2006.

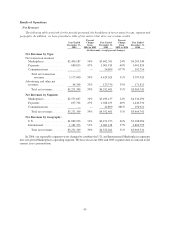

Impact of Foreign Currency Translation

During 2006, 2005 and 2004, our international net revenues, based upon the country in which the seller,

payment recipient, Skype user’s Internet protocol address, advertiser or other service provider is located, accounted

for approximately 48%, 46% and 42%, of our consolidated net revenues, respectively. The growth in our

international operations has increased our exposure to foreign currency fluctuations. Net revenues and related

expenses generated from most international locations are denominated in the functional currencies of the local

countries, and primarily include Euros, British pounds, Korean won, Canadian dollars, Australian dollars, Chinese

renminbi, and Indian rupees. Our results of operations and certain of our inter-company balances associated with

our international locations are exposed to foreign exchange rate fluctuations. The statements of income of our

international operations are translated into U.S. dollars at the average exchange rates in each applicable period. If

the U.S. dollar weakens against foreign currencies, the translation of these foreign-currency-denominated trans-

actions will result in increased consolidated net revenues, operating expenses, and net income. Similarly, our net

revenues, operating expenses, and net income will decrease if the U.S. dollar strengthens against foreign currencies.

53