XM Radio 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

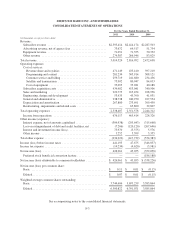

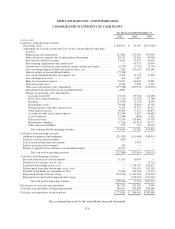

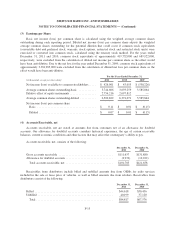

SIRIUS XM RADIO INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS — (Continued)

For the Years Ended December 31,

2011 2010 2009

(in thousands)

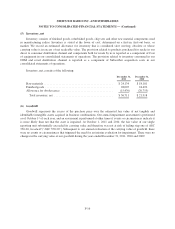

Supplemental Disclosure of Cash and Non-Cash Flow Information

Cash paid during the period for:

Interest, net of amounts capitalized ................................ $258,676 $241,160 $257,328

Non-cash investing and financing activities:

Share-based payments in satisfaction of accrued compensation .......... $ — $ — $ 31,291

Common stock issued in exchange of 2.5% Convertible Notes due

2009 including, accrued interest ................................ $ — $ — $ 18,000

Structuring fee on 10% Senior PIK Secured Notes due 2011 ............ $ — $ — $ 5,918

Preferred stock issued to Liberty Media ............................ $ — $ — $227,716

Release of restricted investments .................................. $ — $ — $137,850

In-orbit satellite performance incentive ............................. $ — $ 21,450 $ 14,905

Sale-leaseback of equipment ..................................... $ — $ 5,305 $ —

Common stock issuance upon exercise of warrants .................... $ 7 $ — $ —

Conversion of Series A preferred stock to common stock ............... $ — $ 25 $ —

See accompanying notes to the consolidated financial statements.

F-7