XM Radio 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

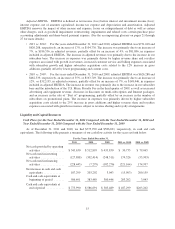

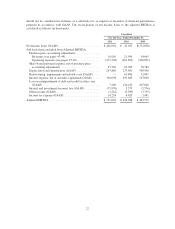

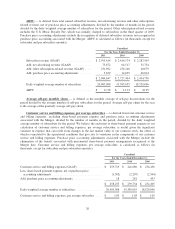

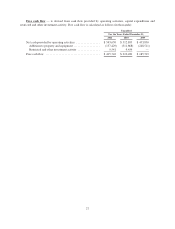

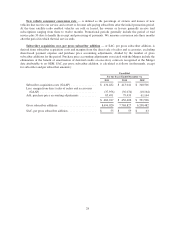

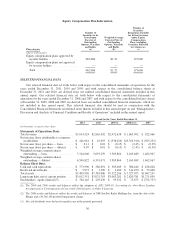

should not be considered in isolation, as a substitute for, or superior to measures of financial performance

prepared in accordance with GAAP. The reconciliation of net income (loss) to the adjusted EBITDA is

calculated as follows (in thousands):

Unaudited

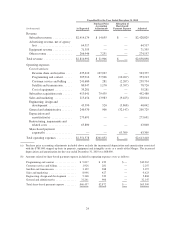

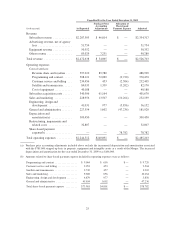

For the Years Ended December 31,

2011 2010 2009

Net income (loss) (GAAP): ........................... $426,961 $ 43,055 $(352,038)

Add back items excluded from Adjusted EBITDA:

Purchase price accounting adjustments: ................

Revenues (see pages 47-49) ....................... 10,910 21,906 54,065

Operating expenses (see pages 47-49) ............... (277,258) (261,832) (240,891)

Share-based payment expense, net of purchase price

accounting adjustments .......................... 53,369 63,309 78,782

Depreciation and amortization (GAAP) ................ 267,880 273,691 309,450

Restructuring, impairments and related costs (GAAP) .... — 63,800 32,807

Interest expense, net of amounts capitalized (GAAP) ..... 304,938 295,643 315,668

Loss on extinguishment of debt and credit facilities, net

(GAAP) ...................................... 7,206 120,120 267,646

Interest and investment (income) loss (GAAP) .......... (73,970) 5,375 (5,576)

Other income (GAAP) ............................. (3,252) (3,399) (3,355)

Income tax expense (GAAP) ........................ 14,234 4,620 5,981

Adjusted EBITDA .................................. $731,018 $ 626,288 $ 462,539

22