XM Radio 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

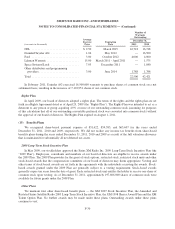

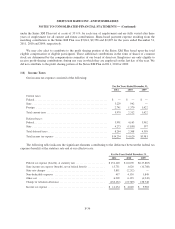

The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income

during the periods in which those temporary differences can be carried forward under tax law. Management’s

evaluation of the realizability of deferred tax assets considers both positive and negative evidence, including

historical financial performance, scheduled reversal of deferred tax assets and liabilities, projected taxable

income and tax planning strategies in making this assessment. The weight given to the potential effects of

positive and negative evidence is based on the extent to which it can be objectively verified. We will not release

the valuation allowance until giving consideration to a variety of factors including but not limited to: (a) the

current period realization of NOL carryforwards, (b) three-year cumulative pre-tax income, (c) the current period

taxable income and (d) the expectation of future earnings. After weighting this evidence, management concluded

that it is more likely than not that our deferred tax assets will not be realized, accordingly, a full valuation

allowance was retained at December 31, 2011.

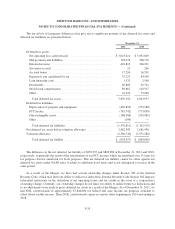

There is no U.S. federal income tax provision as all federal taxable income was offset by utilizing U.S NOL

carryforwards. The state tax provision is primarily related to taxable income in certain states that have suspended

the ability to use NOL carryforwards. The foreign income tax provision is primarily related to foreign

withholding taxes related to royalty income between us and our Canadian affiliate.

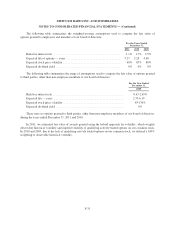

As of December 31, 2011 and 2010, the gross liability for income taxes associated with uncertain state tax

positions, including interest, was $1,524 and $942, respectively, in other long-term liabilities. No penalties have

been accrued for. We do not currently anticipate that our existing reserves related to uncertain tax positions as of

December 31, 2011 will significantly increase or decrease during the twelve-month period ending December 31,

2012; however, various events could cause our current expectations to change in the future. Should our position

with respect to the majority of these uncertain tax positions be upheld, the effect would be recorded in our

consolidated statements of operations as part of the income tax provision. Our policy is to recognize interest and

penalties accrued on uncertain tax positions as part of income tax expense.

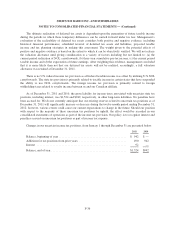

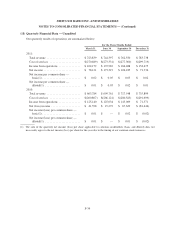

Changes in our uncertain income tax positions, from January 1 through December 31 are presented below:

2011 2010

Balance, beginning of year .............................................. $ 942 $ —

Additions for tax positions from prior years ................................ 490 942

Interest ............................................................. 92 —

Balance, end of year ................................................... $1,524 $942

F-36