XM Radio 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Prior to expiration, we are required to apply for a renewal of our FCC licenses. The renewal and extension

of our licenses is reasonably certain at minimal cost, which is expensed as incurred. Each of the FCC licenses

authorizes us to use the broadcast spectrum, which is a renewable, reusable resource that does not deplete or

exhaust over time.

In connection with the Merger, $250,000 of the purchase price was allocated to the XM trademark. As of

December 31, 2011, there were no legal, regulatory or contractual limitations associated with the XM trademark.

Our annual impairment assessment of our indefinite intangible assets is performed as of October 1st of each

year. An assessment is made at other times if events or changes in circumstances indicate that it is more likely

than not that the assets have been impaired. At October 1, 2011 and 2010, the fair value of our indefinite

intangible assets substantially exceeded its carrying value and therefore was not at risk of impairment.

Subsequent to our annual evaluation of the carrying value of goodwill, there were no events or circumstances that

triggered the need for an interim evaluation for impairment.

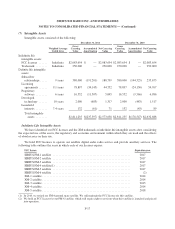

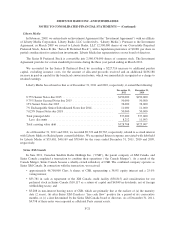

Definite Life Intangible Assets

Subscriber relationships are amortized on an accelerated basis over 9 years, which reflects the estimated

pattern in which the economic benefits will be consumed. Other definite life intangible assets include certain

licensing agreements, which are amortized over a weighted average useful life of 9.1 years on a straight-line

basis.

Amortization expense for all definite life intangible assets was $59,050, $66,324 and $76,587 for the years

ended December 31, 2011, 2010 and 2009, respectively. Expected amortization expense for each of the fiscal

years through December 31, 2016 and for periods thereafter is as follows:

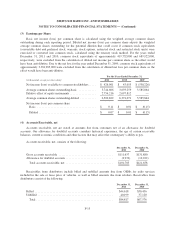

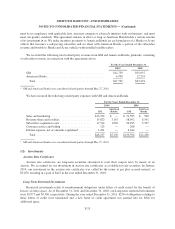

Year ending December 31, Amount

2012 .................................................................... $ 53,680

2013 .................................................................... 47,357

2014 .................................................................... 38,879

2015 .................................................................... 37,553

2016 .................................................................... 31,959

Thereafter ................................................................ 30,556

Total definite life intangibles assets, net ........................................ $239,984

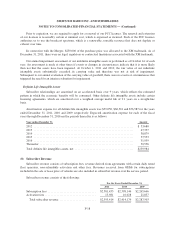

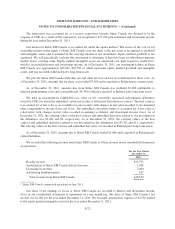

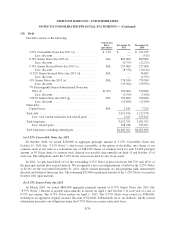

(8) Subscriber Revenue

Subscriber revenue consists of subscription fees, revenue derived from agreements with certain daily rental

fleet operators, non-refundable activation and other fees. Revenues received from OEMs for subscriptions

included in the sale or lease price of vehicles are also included in subscriber revenue over the service period.

Subscriber revenue consists of the following:

For the Years Ended December 31,

2011 2010 2009

Subscription fees ................................. $2,581,433 $2,398,146 $2,265,666

Activation fees ................................... 13,981 16,028 21,837

Total subscriber revenue ......................... $2,595,414 $2,414,174 $2,287,503

F-18