XM Radio 2011 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

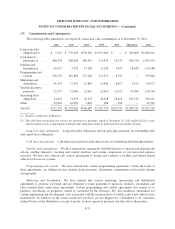

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

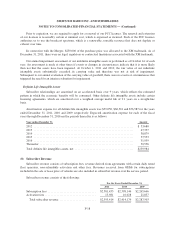

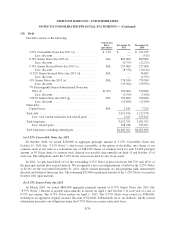

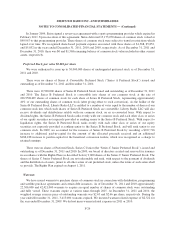

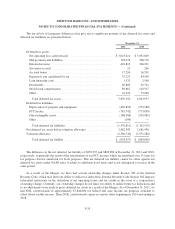

(c) 9.75% Senior Secured Notes due 2015

In August 2009, we issued $257,000 aggregate principal amount of 9.75% Senior Secured Notes due

September 1, 2015 (the “9.75% Notes”). Interest is payable semi-annually in arrears on March 1 and September 1

of each year at a rate of 9.75% per annum. The 9.75% Notes were issued for $244,292, resulting in an aggregate

original issuance discount of $12,708. Substantially all of our domestic wholly-owned subsidiaries guarantee our

obligations under the 9.75% Notes. The 9.75% Notes and related guarantees are secured by first-priority liens on

substantially all of our assets and the assets of the guarantors.

(d) 11.25% Senior Secured Notes due 2013

In June 2009, we issued $525,750 aggregate principal amount of 11.25% Senior Secured Notes due 2013

(the “11.25% Notes”). The 11.25% Notes were issued for $488,398, resulting in an aggregate original issuance

discount of $37,352.

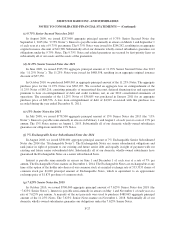

In October 2010, we purchased $489,065 in aggregate principal amount of the 11.25% Notes. The aggregate

purchase price for the 11.25% Notes was $567,927. We recorded an aggregate loss on extinguishment of the

11.25% Notes of $85,216, consisting primarily of unamortized discount, deferred financing fees and repayment

premium to Loss on extinguishment of debt and credit facilities, net, in our 2010 consolidated statements of

operations. The remainder of the 11.25% Notes of $36,685 was purchased in January 2011 for an aggregate

purchase price of $40,376. A loss from extinguishment of debt of $4,915 associated with this purchase was

recorded during the year ended December 31, 2011.

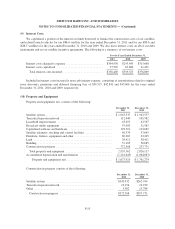

(e) 13% Senior Notes due 2013

In July 2008, we issued $778,500 aggregate principal amount of 13% Senior Notes due 2013 (the “13%

Notes”). Interest is payable semi-annually in arrears on February 1 and August 1 of each year at a rate of 13% per

annum. The 13% Notes mature on August 1, 2013. Substantially all of our domestic wholly-owned subsidiaries

guarantee our obligations under the 13% Notes.

(f) 7% Exchangeable Senior Subordinated Notes due 2014

In August 2008, we issued $550,000 aggregate principal amount of 7% Exchangeable Senior Subordinated

Notes due 2014 (the “Exchangeable Notes”). The Exchangeable Notes are senior subordinated obligations and

rank junior in right of payment to our existing and future senior debt and equally in right of payment with our

existing and future senior subordinated debt. Substantially all of our domestic wholly-owned subsidiaries have

guaranteed the Exchangeable Notes on a senior subordinated basis.

Interest is payable semi-annually in arrears on June 1 and December 1 of each year at a rate of 7% per

annum. The Exchangeable Notes mature on December 1, 2014. The Exchangeable Notes are exchangeable at any

time at the option of the holder into shares of our common stock at an initial exchange rate of 533.3333 shares of

common stock per $1,000 principal amount of Exchangeable Notes, which is equivalent to an approximate

exchange price of $1.875 per share of common stock.

(g) 7.625% Senior Notes due 2018

In October 2010, we issued $700,000 aggregate principal amount of 7.625% Senior Notes due 2018 (the

“7.625% Senior Notes”). Interest is payable semi-annually in arrears on May 1 and November 1 of each year at a

rate of 7.625% per annum. A majority of the net proceeds were used to purchase $489,065 aggregate principal

amount of the 11.25% Notes. The 7.625% Senior Notes mature on November 1, 2018. Substantially all of our

domestic wholly-owned subsidiaries guarantee our obligations under the 7.625% Senior Notes.

F-27