XM Radio 2011 Annual Report Download - page 32

Download and view the complete annual report

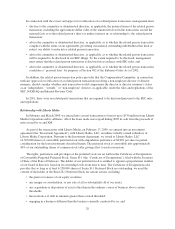

Please find page 32 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At our annual meeting in May 2011, we held an advisory “say on pay” vote on the compensation of our

named executive officers. Our stockholders overwhelmingly approved the compensation of our named executive

officers, with over 98% of the voting power of our common stock and Series B-1 Preferred Stock, voting

together as a single class, present in person or by proxy and entitled to vote on the proposal casting votes in favor

of our 2011 say-on-pay resolution. In making compensation decisions for 2011, the Compensation Committee

considered the strong support our stockholders expressed for our pay for performance compensation philosophy

and therefore did not make changes to the core elements of our compensation programs, except for the addition

of a Section 162(m)-compliant bonus plan.

We intend to include an advisory “say on pay” vote on the compensation of our named executive officers

every three years. Accordingly, the next such vote will be held at our 2014 annual meeting of stockholders.

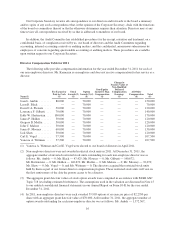

Fiscal Year 2011 Performance Summary

We had a very successful year in 2011. In the face of increasing competition for our products, we continued

to invest in infrastructure, new products, high-quality programming and our brand. Further, our financial results

exceeded our projections and were reflected in a 12% increase in our year-over-year stock price. The following

highlights our financial and operating results:

• achieving adjusted EBITDA growth of 17% to over $731 million in 2011;

• increasing our revenue by 7%; and

• increasing our free cash flow by 98% to $416 million, and reducing our long-term debt by over $200 million.

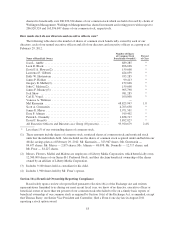

In addition, 2011 was marked by key subscriber and content-based achievements and other measures that

contributed to our continued growth and success, including:

• adding approximately 1.7 million net new subscribers, resulting in a total of nearly 21.9 million

subscribers, an increase of over 8% as compared to 2010;

• launching SiriusXM 2.0, a technology which expanded our channel lineup to include new music, sports and

comedy channels, as well as the debut of SiriusXM Latino, a suite of new Latin channels featuring

programming from leading providers of Spanish-language music, sports, news, talk and entertainment; and

• introducing our Lynx portable radio, our most advanced radio to date that allows subscribers to pause,

rewind, replay and store content.

In this CD&A, we use certain financial performance measures that are not calculated and presented in

accordance with generally accepted accounting principles in the United States of America (“Non-GAAP”). These

Non-GAAP financial measures include adjusted EBITDA and free cash flow. We also use in this CD&A

subscriber churn, a performance metric which management uses in measuring our business. We use these

Non-GAAP financial measures and other performance metrics to manage our business, set operational goals and,

in certain cases, as a basis for determining compensation for our employees. Please refer to the glossary

contained in our Annual Report for the year ended December 31, 2011 which accompanies this proxy statement

for a discussion of such Non-GAAP financial measures and reconciliations to the most directly comparable

GAAP measure and a discussion of these other performance metrics.

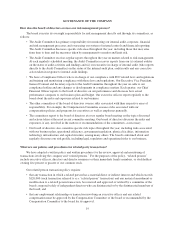

Overall Program Objectives and Processes

Program Objectives

We strive to attract, motivate and retain high-quality executives with the skills and experience necessary to

achieve our key business goals and enhance stockholder value by providing total compensation that is largely

performance-based and competitive with the various markets and industries in which we compete for talent. We

strive to provide incentives to align the interests of our executives with those of our stockholders and deliver

levels of compensation that we believe are commensurate with performance.

22