XM Radio 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

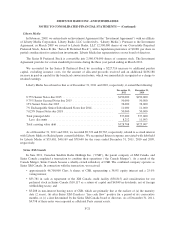

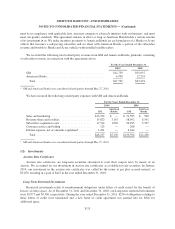

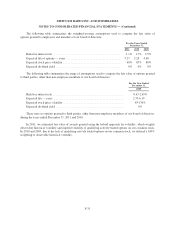

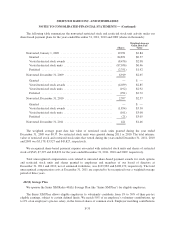

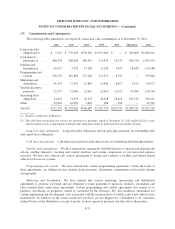

The following table summarizes the weighted-average assumptions used to compute the fair value of

options granted to employees and members of our board of directors:

For the Years Ended

December 31,

2011 2010 2009

Risk-free interest rate .............................................. 1.1% 1.7% 2.5%

Expected life of options — years ..................................... 5.27 5.28 4.68

Expected stock price volatility ....................................... 68% 85% 88%

Expected dividend yield ............................................ 0% 0% 0%

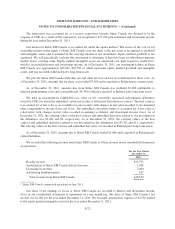

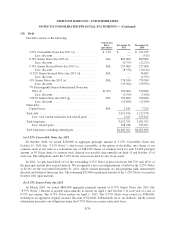

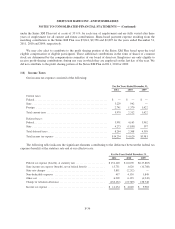

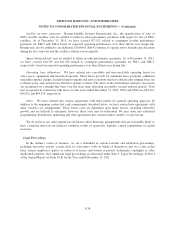

The following table summarizes the range of assumptions used to compute the fair value of options granted

to third parties, other than non-employee members of our board of directors:

For the Year Ended

December 31,

2009

Risk-free interest rate ................................................. 0.67-2.69%

Expected life — years ................................................ 2.33-6.19

Expected stock price volatility .......................................... 83-130%

Expected dividend yield ............................................... 0%

There were no options granted to third parties, other than non-employee members of our board of directors,

during the years ended December 31, 2011 and 2010.

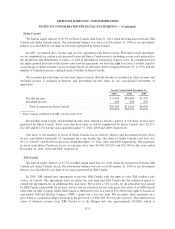

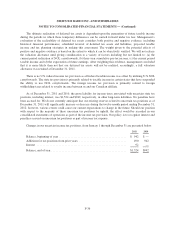

In 2011, we estimated fair value of awards granted using the hybrid approach for volatility, which weights

observable historical volatility and implied volatility of qualifying actively traded options on our common stock.

In 2010 and 2009, due to the lack of qualifying actively traded options on our common stock, we utilized a 100%

weighting to observable historical volatility.

F-31