XM Radio 2011 Annual Report Download - page 45

Download and view the complete annual report

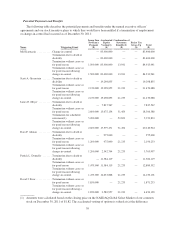

Please find page 45 of the 2011 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Non-Qualified Deferred Compensation and Pension Benefits

We do not offer non-qualified deferred compensation or pension benefits to our named executive officers.

Potential Payments or Benefits Upon Termination or Change-in-Control

Employment Agreements

We have entered into an employment agreement with each of our named executive officers that contains

provisions regarding payments or benefits upon a termination of employment or change of control.

Mel Karmazin

In November 2004, we entered into a five year term employment agreement with Mel Karmazin to serve as

our Chief Executive Officer. In June 2009, we amended our employment agreement with Mr. Karmazin to

(i) extend the term of his employment agreement through December 31, 2012, (ii) increase his base salary from

$1,250,000 per year to $1,500,000 per year beginning on January 1, 2010, and (iii) provide for a grant of an

option to purchase 120,000,000 shares of our common stock, at an exercise price of $0.430 per share (the closing

price of our common stock on the date of the amendment). Mr. Karmazin is also entitled under his employment

agreement to an annual cash bonus as determined by the Compensation Committee.

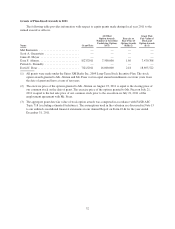

The options granted to Mr. Karmazin in connection with the amending of his employment agreement vest in

equal installments on each of December 31, 2010, December 31, 2011, June 30, 2012 and December 31, 2012,

with potential accelerated vesting upon the termination of Mr. Karmazin’s employment by us without cause, by

him for good reason, upon his death or disability and in the event of a change of control. These options will

generally expire no later than December 31, 2014; provided that if the parties subsequently agree to extend the

term of his employment agreement through December 31, 2013 or later, then the term of these options will

automatically extend until the later of (i) December 31, 2015 and (ii) the date that is one year following the date

that such new employment agreement expires, but no later than the 10th anniversary of the date of grant.

In the event Mr. Karmazin’s employment is terminated by us without cause or by Mr. Karmazin for good

reason, his unvested stock options will vest immediately and become exercisable, and we will be obligated to pay

Mr. Karmazin upon termination, in a lump sum, his current base salary through December 31, 2012, any earned

but unpaid annual bonus, a pro rata portion of his target bonus for the year in which the termination occurs (if

established) and to continue his health and life insurance benefits through December 31, 2012.

In the event Mr. Karmazin’s employment is terminated as a result of his death or by us as a result of his

disability, subject to Mr. Karmazin (or his beneficiary or his estate, as applicable) executing a release of claims,

the vesting of his unvested stock options will accelerate and become exercisable.

In the event that any payment we make, or benefit we provide, to Mr. Karmazin would require him to pay an

excise tax under Section 280G of the Internal Revenue Code, we have agreed to pay Mr. Karmazin the amount of

such tax and such additional amount as may be necessary to place him in the exact same financial position that he

would have been in if the excise tax was not imposed.

Scott A. Greenstein

In July 2009, we entered into a new employment agreement with Scott A. Greenstein to continue to serve as

our President and Chief Content Officer through July 27, 2013. The employment agreement provides for an

initial annual base salary of $850,000 and specified increases to no less than $925,000 in January 2010,

$1,000,000 in January 2011, $1,100,000 in January 2012, and $1,250,000 in January 2013. Mr. Greenstein

waived the increase in his base salary that was scheduled to take effect in January 2012 under his employment

agreement. Mr. Greenstein is also entitled to participate in any bonus plans generally offered to our executive

officers.

35