Westjet 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

YOUR OWNERS’ MANUAL

9. Commitments and contingencies (continued):

(c) Contingencies (continued):

declared Bankruptcy. As a result, this action has been stayed and no further steps can be taken in the litigation unless a

court order is obtained.

Based on the results to date of (i) an internal investigation, (ii) advice from independent industry experts, and (iii) cross-

examinations of witnesses in the Air Canada proceedings, and (iv) evidence filed by the Plaintiffs in support of various

court applications, management believes the amounts claimed are substantially without merit. The amount of loss, if any,

to the Corporation as a result of these two claims cannot be reasonably estimated. The defence and investigation of these

claims are continuing.

The Corporation is party to other legal proceedings and claims that arise during the ordinary course of business. It is the

opinion of management that the ultimate outcome of these matters will not have a material effect upon the Corporation’s

financial position, results of operations or cash flows.

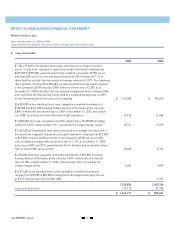

10. Financial instruments and risk management:

(a) Fuel risk management:

The Corporation periodically utilizes short-term and long-term financial and physical derivative

instruments to mitigate

its exposure to fluctuations in jet fuel prices and accounts for these derivatives

as cash flow hedges. For the year ended

December 31, 2005, the Corporation recognized a net gain of $155,000 in aircraft fuel resulting from hedging transactions.

As at December 31, 2005, the Corporation has outstanding hedge contracts representing approximately

50%, 40% and 11%

respectively of January, February and March anticipated fuel consumption at a rate of $0.572/litre, $0.580/litre and

$0.562/litre. The total fair market value of the unsettled contracts as at December 31, 2005 is an estimated loss of $1,300,000.

(b) Foreign currency exchange risk:

The Corporation is exposed to foreign currency fluctuations as certain ongoing expenses are referenced to US dollar

denominated prices. The Corporation periodically uses financial instruments, including foreign exchange forward

contracts and options, to manage its exposure.

The Corporation has entered into a contract to purchase US $2.5 million per month at a forward rate of 1.22 for

the payment period from March 2005 to February 2006 to hedge a portion of the Corporation’s committed US dollar

lease payments during the same period. The estimated fair market value of the remaining portion of the contract as at

December 31, 2005 is a loss of $300,000.

Included in cash and cash equivalents at December 31, 2005 is US $35,453,000 (2004 – US $28,440,000).

(c) Interest rate risk:

The Corporation is exposed to interest rate fluctuations on variable interest rate debt (see note 4).

The Corporation has entered into forward starting interest rate agreements at rates between 4.98% and 5.00% on six

future aircraft deliveries, effective from the period April 2006 and July 2006.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

WestJet Airlines Ltd.

Years ended December 31, 2005 and 2004

(Tabular Amounts are Stated in Thousands of Dollars, Except Share and Per Share Data)