Westjet 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

YOUR OWNERS’ MANUAL

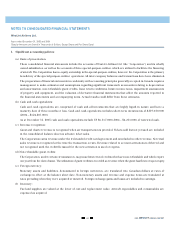

1. Significant accounting policies (continued):

(g) Deferred costs:

Sales and marketing and customer service expenses attributed to advance ticket sales are deferred and expensed in the

period the related revenue is recognized. Included in prepaid expenses and deposits are $13,236,000 (2004 - $7,400,000)

of deferred costs.

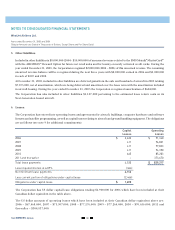

(h) Property and equipment:

Property and equipment are recorded at cost and depreciated to their estimated residual values. Aircraft under capital

lease are initially recorded at the present value of minimum lease payments at the inception of the lease.

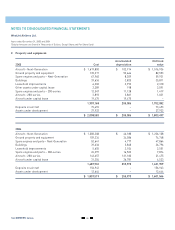

Asset Basis Rate

Aircraft net of estimated residual value – Next-Generation Cycles Cycles flown

Live satellite television included in Aircraft – Next-Generation Straight-line 10 years/lease term

Aircraft net of estimated residual value – 200-series Flight hours Hours flown

Ground property and equipment Straight-line 5 to 25 years

Spare engines and parts net of estimated residual

value – Next-Generation Straight-line 20 years

Spare engines and parts net of estimated residual

value – 200-series Flight hours Fleet hours flown

Aircraft under capital lease Straight-line Term of lease

Other assets under capital lease Straight-line Term of lease

Buildings Straight-line 40 years

Leasehold improvements Straight-line Term of lease

Property and equipment is reviewed for impairment whenever events or changes in circumstances indicate that the

carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a

comparison of the carrying amount of an asset to estimated undiscounted future cash flows expected to be generated

by the asset. If the carrying amount of an asset exceeds its estimated future cash flows, an impairment charge is recognized

by the amount by which the carrying amount of the asset exceeds the fair value of the asset.

(i) Maintenance costs:

Maintenance and repairs, including major overhauls, are charged to maintenance expense as they are incurred.

(j) Capitalized costs:

Costs associated with assets under development which have probable future economic benefit, which can be clearly

defined and measured and are costs incurred for the development of new products or technologies, are capitalized.

Interest attributable to funds used to finance property and equipment is capitalized to the related asset. Legal and

financing costs for the loan facilities are capitalized to other assets on the balance sheet and amortized on a straight-line

basis over the term of the related loan.

Costs of new route development are expensed as incurred.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

WestJet Airlines Ltd.

Years ended December 31, 2005 and 2004

(Tabular Amounts are Stated in Thousands of Dollars, Except Share and Per Share Data)