Westjet 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

YOUR OWNERS’ MANUAL

Compensation

WestJetters have embraced and benefited from our

compensation strategy of aligning corporate success with

personal success. With the many challenges we overcame

in 2005, our people’s belief and faith in WestJet never

faltered as evidenced by the fact that participation in our

employee share purchase plan remained constant at 86%,

although contribution levels slightly declined from 13%

of base salaries in 2004 to 12% in 2005. Our matching

expense in 2005 was $21.7 million, a 16.0% increase from

2004’s $18.7 million.

Our salary and benefit costs, as a percentage of our

total expenses, remained unchanged at approximately

19% in 2005 and 2004. Our salary and benefit costs on a

per-ASM basis increased 12.9% to 2.36 cents in 2005

compared to 2.09 cents in 2004, and the number of

full-time equivalent employees increased by 6.5% at

year-end 2005 over 2004.

We recorded $6.0 million in profit share expense

during the year, which is based on year-to-date margin,

subject to approval by the Board of Directors, and is paid

out in May and November annually.

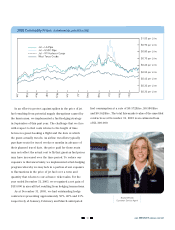

Foreign Exchange

The Canadian dollar continued to strengthen throughout

the year, ending the year at $0.86 relative to the US dollar.

WestJet’s exposure to the US dollar primarily relates to

aircraft lease payments, jet fuel, airport operations at our

US destinations and certain maintenance costs.

To minimize our risk in foreign exchange movements

related to our US-dollar operating expenditures, we

carry US-dollar cash and cash equivalents to meet these

obligations. On average, we had a balance of approximately

US $29 million in cash and cash equivalents on hand

throughout the year. As a result of the strengthening

Canadian dollar during 2005, we incurred a total foreign

exchange loss of $2.7 million, primarily as a result of

these cash balances.

We have entered into a contract to purchase US $2.5

million per month at a forward rate of 1.22 for the payment

period from March 2005 to February 2006 to hedge a

portion of our committed US dollar lease payments during

the same period. The estimated fair market value of the

remaining portion of the contract as at December 31, 2005

was a loss of $300,000.

We estimate that for every $0.01 downward movement

in the Canadian dollar in relation to the US dollar (e.g. $0.83

to $0.82), our pre-tax operating expense increases by

approximately $6.0 million.

Income Taxes

Our operations span across several tax jurisdictions,

which subjects our income to various rates of tax. As well,

the computation of the provision for income taxes involves

the interpretation of legislation and regulations that are

in constant states of change. As a result, taxes paid or

recovered can ultimately be different from those estimated.

The current tax recovery of $7.4 million, combined

with the future tax provision of $35.3 million, resulted in a

Matt Engelhardt

Tax Manager