Westjet 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

YOUR OWNERS’ MANUAL

are reported in Canadian dollars. This information should

be read in conjunction with the consolidated financial

statements for the year ended December 31, 2005 and

related notes thereto.

YEAR 2005 COMPARED TO YEAR 2004

Revenue

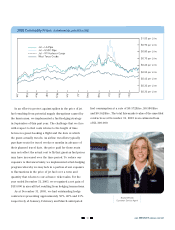

Although the revenue environment remains competitive,

the demise of Jetsgo has allowed yield (revenue per

passenger mile) and load factor to begin to return to more

rational levels. This is evidenced by the fact that even with

an increase in capacity of 19.1% as measured by available

seat miles (“ASMs”), we were able to increase our yield by

3.6% to 17.5 cents in full-year 2005 from 16.9 cents in 2004.

As a result of this improved performance, guest revenues

increased 29.7% from 2004 to $1.21 billion in 2005. Total

revenue, which includes guest revenue, charter and other

revenue, and interest income, increased to $1.40 billion,

a 32.1% improvement over the $1.06 billion recorded in

2004. Charter and other revenue growth continue to

outpace guest revenue growth; charter revenue totalled

$126.6 million in 2005 representing an increase of 54.4%

compared with 2004 revenue of $82.0 million. However,

Expenses

the expansion of scheduled flights into Las Vegas, which

had previously been flown on a charter basis for a tour

operator, constraints on our own aircraft availability and

the impact of hurricanes in 2005 caused limited growth in

this segment of our business in the latter part of 2005.

In 2005, we increased capacity, as measured by ASMs,

by 19.1% and increased the number of revenue passenger

miles (“RPMs”) by 26.8% to 10.7 billion and 8.0 billion

respectively compared to 9.0 billion and 6.3 billion in

2004. This performance resulted in an increased annual

load factor from 70.0% in 2004 to 74.6% in 2005 – a level

not seen since 2001.

Ancillary revenue, generated primarily from fees

associated with guest itinerary changes, excess baggage

fees and headset sales, contributed $38.1 million to other

revenue in 2005 as compared to $25.6 million in 2004.

Cargo revenue, which increased 28.1% from $6.4 million

in 2004, added $8.2 million to other revenue in 2005.

We also recognized $2.0 million in net retail sales and

for bounty on newly activated credit cards during the

year through our BMO Mosaik®MasterCard®*with the

AIR MILES®†Reward Option. In 2004, no revenue was

recognized with respect to this program.

2005 2004 2003 2002 2001

Aircraft fuel 3.32 2.69 2.27 2.40 2.83

Airport operations 2.05 1.94 1.78 1.90 2.13

Flight operations and navigational charges 1.72 1.66 1.53 1.63 1.76

Sales and marketing 1.16 0.95 0.84 0.96 1.03

Depreciation and amortization(1) 1.00 0.88 0.92 1.13 1.15

Maintenance 0.71 0.88 1.10 1.76 2.41

General and administration 0.65 0.68 0.67 0.86 0.70

Aircraft leasing 0.62 0.46 0.64 0.77 0.51

Interest expense 0.52 0.49 0.36 0.16 0.16

Inflight 0.50 0.49 0.47 0.59 0.54

Customer service 0.26 0.26 0.32 0.43 0.59

12.51 11.38 10.90 12.59 13.81

(1) For comparative purposes, impairment loss of $47,577,000 included in depreciation and amortization expense has been excluded from unit-cost calculations for 2004.

Cost per available seat mile (CASM) (in cents)

®Registered trade-marks of Bank of Montreal. Patent Pending. ®*Bank of Montreal is a licenced user of the registered trademark and design of MasterCard International Inc. ®†Trademarks of AIR MILES International Trading B.V. Used under license by Loyalty Management Group Canada Inc.