Westjet 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

YOUR OWNERS’ MANUAL

7. Share capital (continued):

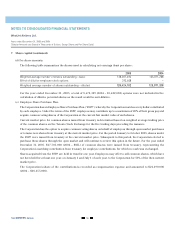

(d) Per share amounts:

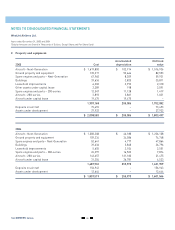

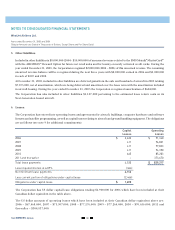

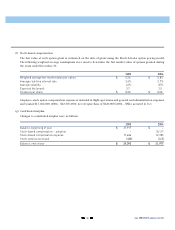

The following table summarizes the shares used in calculating net earnings (loss) per share:

2005 2004

Weighted average number of shares outstanding – basic 128,031,694 125,071,208

Effect of dilutive employee stock options 392,408 –

Weighted average number of shares outstanding – diluted 128,424,102 125,071,208

For the year ended December 31, 2005, a total of 8,672,329 (2004 – 10,682,082) options were not included in the

calculation of dilutive potential shares as the result would be anti-dilutive.

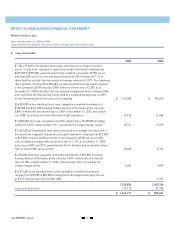

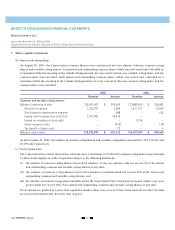

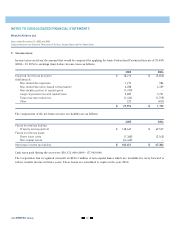

(e) Employee Share Purchase Plan:

The Corporation has an Employee Share Purchase Plan (“ESPP”) whereby the Corporation matches every dollar contributed

by each employee. Under the terms of the ESPP, employees may contribute up to a maximum of 20% of their gross pay and

acquire common voting shares of the Corporation at the current fair market value of such shares.

Current market price for common shares issued from treasury is determined based on weighted average trading price

of the common shares on the Toronto Stock Exchange for the five trading days preceding the issuance.

The Corporation has the option to acquire common voting shares on behalf of employees through open market purchases

or to issue new shares from treasury at the current market price. For the period January to October 2005, shares under

the ESPP were issued from treasury at the current market price. Subsequent to this period, the Corporation elected to

purchase these shares through the

open market and will continue to review this option in the future. For the year ended

December 31, 2005,

$17,705,000 (2004 – $NIL) of common shares were issued from treasury, representing the

Corporation’s matching contribution from treasury for employee contributions, for which no cash was exchanged.

Shares acquired from the ESPP are held in trust for one year. Employees may offer to sell common shares, which have

not been held for at least one year, on January 1 and July 1 of each year, to the Corporation for 50% of the then current

market price.

The Corporation’s share of the contributions is recorded as compensation expense and amounted to $21,690,000

(2004 – $18,655,000).

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

WestJet Airlines Ltd.

Years ended December 31, 2005 and 2004

(Tabular Amounts are Stated in Thousands of Dollars, Except Share and Per Share Data)