Westjet 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 WESTJET ANNUAL REPORT

19

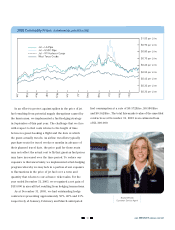

In an effort to protect against spikes in the price of jet

fuel resulting from potential supply disruptions caused by

the hurricanes, we implemented a fuel-hedging strategy

in September of this past year. The challenge that we face

with respect to fuel costs relates to the length of time

between a guest booking a flight and the date at which

the guest actually travels. As airline travellers typically

purchase seats for travel weeks or months in advance of

their planned travel date, the price paid for those seats

may not reflect the actual cost to fly that guest as fuel prices

may have increased over the time period. To reduce our

exposure to that uncertainty, we implemented a fuel-hedging

program whereby we may lock in a portion of our exposure

to fluctuations in the price of jet fuel over a term and

quantity that relates to our advance ticket sales. For the

year ended December 31, 2005, we recognized a net gain of

$155,000 in aircraft fuel resulting from hedging transactions.

As at December 31, 2005, we had outstanding hedge

contracts representing approximately 50%, 40% and 11%

respectively of January, February and March anticipated

fuel consumption at a rate of $0.572/litre, $0.580/litre

and $0.562/litre. The total fair-market value of the unsettled

contracts as at December 31, 2005 is an estimated loss

of $1,300,000.

Nadia DiPardo

Customer Service Agent

$1.00 per Litre

$0.90 per Litre

$0.80 per Litre

$0.70 per Litre

$0.60 per Litre

$0.50 per Litre

$0.40 per Litre

$0.30 per Litre

$0.20 per Litre

2005 Commodity Prices (CANADIAN DOLLARS PER LITRE)