Westjet 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 WESTJET ANNUAL REPORT

55

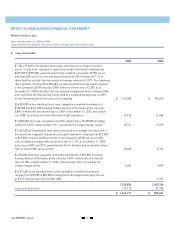

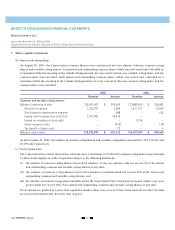

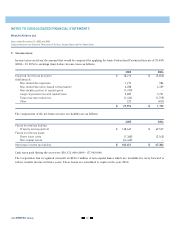

(f) Stock-based compensation:

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model.

The following weighted average assumptions were used to determine the fair market value of options granted during

the years ended December 31:

2005 2004

Weighted average fair market value per option $ 5.26 $ 5.83

Average risk-free interest rate 3.4% 3.7%

Average volatility 43% 45%

Expected life (years) 3.7 3.5

Dividend per share $ 0.00 $ 0.00

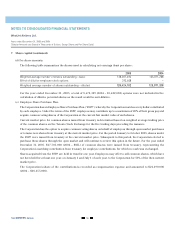

Employee stock option compensation expense is included in flight operations and general and administration expenses

and totaled $17,604,000 (2004 - $12,305,000), net of repurchase of $320,000 (2004 – $NIL) as noted in 7(c).

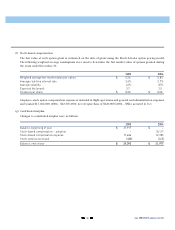

(g) Contributed surplus:

Changes to contributed surplus were as follows:

2005 2004

Balance, beginning of year $ 21,977 $ –

Stock-based compensation – adoption – 10,117

Stock-based compensation expense 17,604 12,305

Stock-options exercised (488) (445)

Balance, end of year $ 39,093 $ 21,977