Westjet 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 WESTJET ANNUAL REPORT

23

Sales and Marketing

Over the course of the year, our sales and marketing

team developed and implemented various offers and

initiatives aimed at enhancing the experience of our guests.

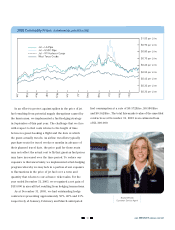

Our total sales and marketing expenses, as a percentage

of total revenue, increased slightly to 8.9% in 2005 from

8.1% in 2004. We expect this percentage to remain

constant in 2006. Sales and marketing expenses increased

from $85.2 million in 2004 to $124.2 million in 2005,

reflecting a 45.8% increase year over year. It is evident

that these initiatives have been successful in boosting

guest revenues, which rose over 29% from 2004 and

raised awareness of our airline across Canada through a

national advertising campaign.

Sales and marketing encompasses a wide variety of

expenses, ranging from advertising and promotional

expenses; sales-related costs, such as agency commissions,

credit card fees and global distribution system costs;

the AIR MILES®reward miles program and live satellite

television licensing fees. CASM for sales and marketing

expenses increased 22.1% from 0.95 cents in 2004 to

1.16 cents in 2005.

In the first half of 2005, we responded successfully

to the economic challenges posed by Jetsgo – prior to its

cessation of operations on March 11, was selling fares

well below the cost of providing those services. Because

of the volume of advance sales, the effect of seats sold in

advance resulted in all Canadian carriers competing in an

irrational pricing environment months after Jetsgo’s demise.

However, our low-cost structure shielded us from the full

impact this weak pricing environment had on other

carriers, and helped guide us to our return to profitability

in the second quarter of 2005.

In 2005, we successfully deployed a new revenue

management system to address issues we were experiencing

with our revenue and inventory management system in

late 2004. We now utilize an industry-leading revenue

management system that allows us to better manage seat

inventory and ultimately provide the best pricing for our

guests, while maximizing returns for our investors.

We have always been supportive and appreciative of the

large network of travel agents that book their clients on our

flights, as travel agents provide an important distribution

channel and help to grow our guest base. To continue

to serve the travel agency market, as well as to acquire

more of corporate Canada’s business, we increased the

size and scope of our corporate sales team in 2005. We

also expanded our specialty sales team to provide

increased services to leisure travellers seeking packaged

vacations and to provide assistance to large groups with

their travel arrangements.

With the end of our 10th year of operations in the first

quarter of 2006, we felt it timely to refresh the WestJet

brand. This was kicked off in 2005 with a campaign we call

“Owners” that produced very favourable reactions across

Canada from both the corporate and leisure travel sector.

As shareholders, most WestJetters are themselves

“Owners,” so the brand message reinforces the reasons for

our success, which stem from our dedicated team of people.

Jan Kerstiens

Workforce Payroll Director