Westjet 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 WESTJET ANNUAL REPORT

49

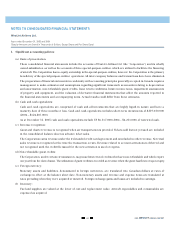

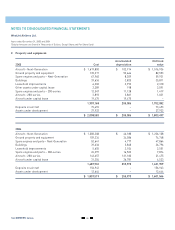

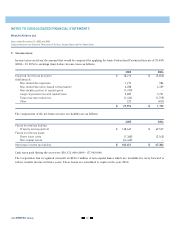

The net book value of the property and equipment pledged as collateral for the Corporation’s secured borrowings was

$1,549,107,000 as at December 31, 2005 (2004 – $1,288,497,000).

Held within the special-purpose entities, as described in note 1, are liabilities of $1,392,629,000 (2004 – $1,178,239,000) and

corresponding assets of $1,393,801,000 (2004 – $1,178,342,000), which are included in the consolidated financial statements.

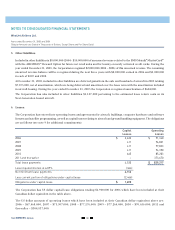

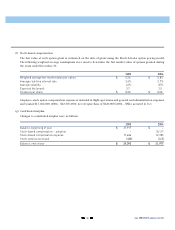

Future scheduled repayments of long-term debt are as follows:

2006 $ 114,115

2007 114,300

2008 127,279

2009 111,514

2010 110,660

2011 and thereafter 580,966

$ 1,158,834

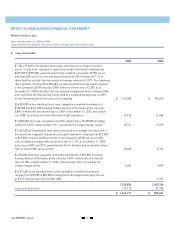

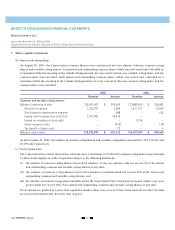

During the year, the Corporation converted US $402 million of preliminary commitments with the Export-Import Bank of the

United States (“Ex-Im Bank”) into a final commitment to support the acquisition of five Boeing Next-Generation 737-700

aircraft and eight Boeing Next-Generation 737-600 aircraft, their related live satellite television systems and installation of

winglets on the 600-series aircraft, to be delivered between July 2005 and July 2006. As at December 31, 2005 the unutilized

and uncancelled balance of the final commitment from Ex-Im Bank was US $188.8 million. In addition, Ex-Im Bank has

provided a preliminary commitment of US $324 million to cover an additional 10 aircraft to be delivered between July 2006

and November 2007.

During the year, the Corporation completed financing arrangements for US $386 million supported by loan guarantees from

the Ex-Im Bank on 13 aircraft as outlined above. This facility will be drawn in Canadian dollars, in separate instalments,

with 12-year terms for each new aircraft. Each loan will be amortized on a straight-line basis over the 12-year term with

quarterly principal instalments, and interest calculated on the outstanding balance. As at December 31, 2005 the Corporation

has taken delivery of the first seven aircraft under this facility and has drawn a total of $256.4 million (US $213.2 million).

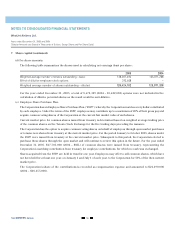

The Corporation is charged a commitment fee of 0.125% per annum on the unutilized and uncancelled balance of the

Ex-Im Bank final commitment, payable at specified dates and upon delivery of an aircraft, and is charged a 3% exposure

fee on the financed portion of the aircraft price, payable upon delivery of an aircraft.

The Corporation has available a facility with a Canadian chartered bank of $8,000,000 (2004 – $8,000,000) for letters of

guarantee. At December 31, 2005, letters of guarantee totaling $6,830,000 (2004 – $7,977,000) have been issued under this

facility. The facility is secured by a general security agreement and an assignment of insurance proceeds.

Cash interest paid during the year was $54,688,000 (2004 – $42,346,000).