United Healthcare 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

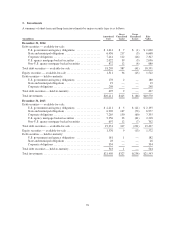

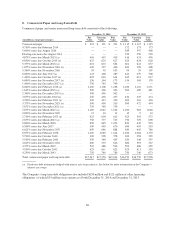

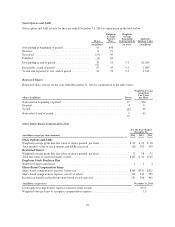

8. Commercial Paper and Long-Term Debt

Commercial paper and senior unsecured long-term debt consisted of the following:

December 31, 2014 December 31, 2013

(in millions, except percentages)

Par

Value

Carrying

Value

Fair

Value

Par

Value

Carrying

Value

Fair

Value

Commercial paper ............................. $ 321 $ 321 $ 321 $ 1,115 $ 1,115 $ 1,115

4.750% notes due February 2014 ................. — — — 172 173 173

5.000% notes due August 2014 .................. — — — 389 397 400

Floating-rate notes due August 2014 .............. — — — 250 250 250

4.875% notes due March 2015 (a) ................ 416 419 419 416 431 436

0.850% notes due October 2015 (a) ............... 625 625 627 625 624 628

5.375% notes due March 2016 (a) ................ 601 623 634 601 641 657

1.875% notes due November 2016 (a) ............. 400 397 406 400 398 408

5.360% notes due November 2016 ................ 95 95 103 95 95 107

6.000% notes due June 2017 (a) .................. 441 466 489 441 479 506

1.400% notes due October 2017 (a) ............... 625 616 624 625 613 617

6.000% notes due November 2017 (a) ............. 156 164 175 156 168 178

1.400% notes due December 2017 (a) ............. 750 745 749 — — —

6.000% notes due February 2018 (a) .............. 1,100 1,106 1,238 1,100 1,116 1,271

1.625% notes due March 2019 (a) ................ 500 496 493 500 489 481

2.300% notes due December 2019 (a) ............. 500 496 502 — — —

3.875% notes due October 2020 (a) ............... 450 450 477 450 435 474

4.700% notes due February 2021 (a) .............. 400 413 450 400 416 436

3.375% notes due November 2021 (a) ............. 500 496 519 500 472 494

2.875% notes due December 2021 (a) ............. 750 748 759 — — —

2.875% notes due March 2022 (a) ................ 1,100 1,042 1,104 1,100 981 1,046

0.000% notes due November 2022 ................ 15 10 11 15 9 10

2.750% notes due February 2023 (a) .............. 625 604 613 625 563 572

2.875% notes due March 2023 (a) ................ 750 777 745 750 729 698

5.800% notes due March 2036 ................... 850 845 1,052 850 845 935

6.500% notes due June 2037 ..................... 500 495 670 500 495 593

6.625% notes due November 2037 ................ 650 646 888 650 645 786

6.875% notes due February 2038 ................. 1,100 1,085 1,544 1,100 1,084 1,370

5.700% notes due October 2040 .................. 300 298 378 300 298 329

5.950% notes due February 2041 ................. 350 348 455 350 348 397

4.625% notes due November 2041 ................ 600 593 646 600 593 567

4.375% notes due March 2042 ................... 502 486 536 502 486 459

3.950% notes due October 2042 .................. 625 611 621 625 611 530

4.250% notes due March 2043 ................... 750 740 786 750 740 673

Total commercial paper and long-term debt ......... $17,347 $17,256 $19,034 $16,952 $16,739 $17,596

(a) Fixed-rate debt instruments hedged with interest rate swap contracts. See below for more information on the Company’s

interest rate swaps.

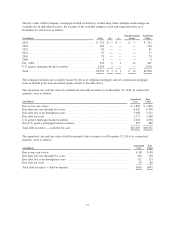

The Company’s long-term debt obligations also included $150 million and $121 million of other financing

obligations, of which $34 million were current as of both December 31, 2014 and December 31, 2013.

86