United Healthcare 2014 Annual Report Download - page 77

Download and view the complete annual report

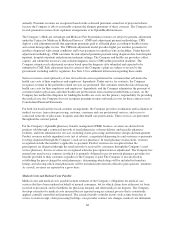

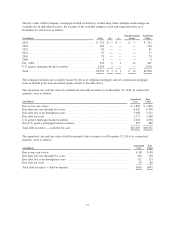

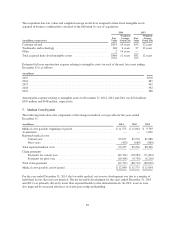

Please find page 77 of the 2014 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company estimates its liability for the Industry Tax based on a ratio of the Company’s applicable net

premiums written compared to the U.S. health insurance industry total applicable net premiums, both for the

previous calendar year. The Company records in full the estimated liability for the Industry Tax at the beginning

of the calendar year with a corresponding deferred cost that is amortized to operating costs on the Consolidated

Statements of Operations using a straight-line method of allocation over the calendar year. The liability is

recorded in accounts payable and accrued liabilities and the corresponding deferred cost is recorded in prepaid

expenses and other current assets on the Consolidated Balance Sheets. In September 2014, the Company paid its

2014 Industry Tax liability of $1.3 billion.

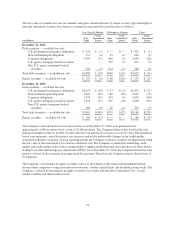

Premium Stabilization Programs

Since the beginning of 2014, Health Reform Legislation has included three programs designed to stabilize health

insurance markets (Premium Stabilization Programs): a permanent risk adjustment program; a temporary risk

corridors program; and a transitional reinsurance program (Reinsurance Program).

The risk-adjustment provisions of Health Reform Legislation are permanent regulations and apply to market

reform compliant individual and small group plans in the commercial markets. Under the program, each covered

member is assigned a risk score based upon demographic information and applicable diagnostic codes from the

current year paid claims, in order to determine an average risk score for each plan in a particular state and market

risk pool. Generally, a plan with a risk score that is less than the state’s average risk score will pay into the pool,

while a plan with a risk score that is greater than the state’s average will receive money from the pool.

The risk corridors provisions of Health Reform Legislation will be in place for three years and are intended to

limit the gains and losses of individual and small group qualified health plans. Plans are required to calculate the

U.S. Department of Health and Human Services (HHS) risk corridor ratio of allowable costs (defined as medical

claims plus quality improvement costs adjusted for the impact of reinsurance recoveries and the risk adjustment

program) to the defined target amount (defined as actual premiums less defined allowable administrative costs

inclusive of taxes and profits). Qualified health plans with ratios below 97% are required to make payments to

HHS, while plans with ratios greater than 103% expect to receive funds from HHS.

The Reinsurance Program is a temporary three year program that is funded on a per capita basis from all

commercial lines of business including insured and self-funded arrangements. Only issuers of market reform

compliant individual plans are eligible for reinsurance recoveries from the risk pools.

None of the Premium Stabilization Programs had a material impact on the Consolidated Financial Statements in

2014.

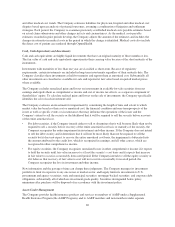

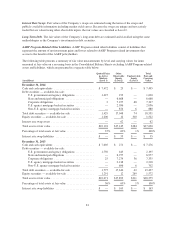

Recently Issued Accounting Standards

In May 2014, the Financial Accounting Standards Board issued Accounting Standard Update (ASU)

No. 2014-09, “Revenue from Contracts with Customers (Topic 606)” (ASU 2014-09). ASU 2014-09 will

supersede existing revenue recognition standards with a single model unless those contracts are within the scope

of other standards (e.g., an insurance entity’s insurance contracts). The revenue recognition principle in ASU

2014-09 is that an entity should recognize revenue to depict the transfer of goods or services to customers in an

amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or

services. In addition, new and enhanced disclosures will be required. Companies can adopt the new standard

either using the full retrospective approach, a modified retrospective approach with practical expedients, or a

cumulative effect upon adoption approach. ASU 2014-09 will become effective for annual and interim reporting

periods beginning after December 15, 2016. Early adoption is not permitted. The Company is currently

evaluating the effect of the new revenue recognition guidance.

The Company has determined that there have been no other recently adopted or issued accounting standards that

had, or will have, a material impact on its Consolidated Financial Statements.

75