United Healthcare 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

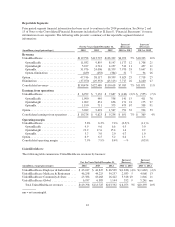

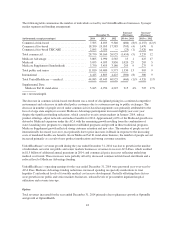

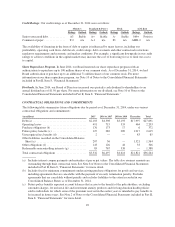

Credit Ratings. Our credit ratings as of December 31, 2014 were as follows:

Moody’s Standard & Poor’s Fitch A.M. Best

Ratings Outlook Ratings Outlook Ratings Outlook Ratings Outlook

Senior unsecured debt ............ A3 Stable A+ Stable A- Stable bbb+ Positive

Commercial paper ............... P-2 n/a A-1 n/a F1 n/a AMB-2 n/a

The availability of financing in the form of debt or equity is influenced by many factors, including our

profitability, operating cash flows, debt levels, credit ratings, debt covenants and other contractual restrictions,

regulatory requirements and economic and market conditions. For example, a significant downgrade in our credit

ratings or adverse conditions in the capital markets may increase the cost of borrowing for us or limit our access

to capital.

Share Repurchase Program. In June 2014, our Board renewed our share repurchase program with an

authorization to repurchase up to 100 million shares of our common stock. As of December 31, 2014, we had

Board authorization to purchase up to an additional 71 million shares of our common stock. For more

information on our share repurchase program, see Note 10 of Notes to the Consolidated Financial Statements

included in Part II, Item 8, “Financial Statements.”

Dividends. In June 2014, our Board of Directors increased our quarterly cash dividend to shareholders to an

annual dividend rate of $1.50 per share. For more information on our dividend, see Note 10 of Notes to the

Consolidated Financial Statements included in Part II, Item 8, “Financial Statements.”

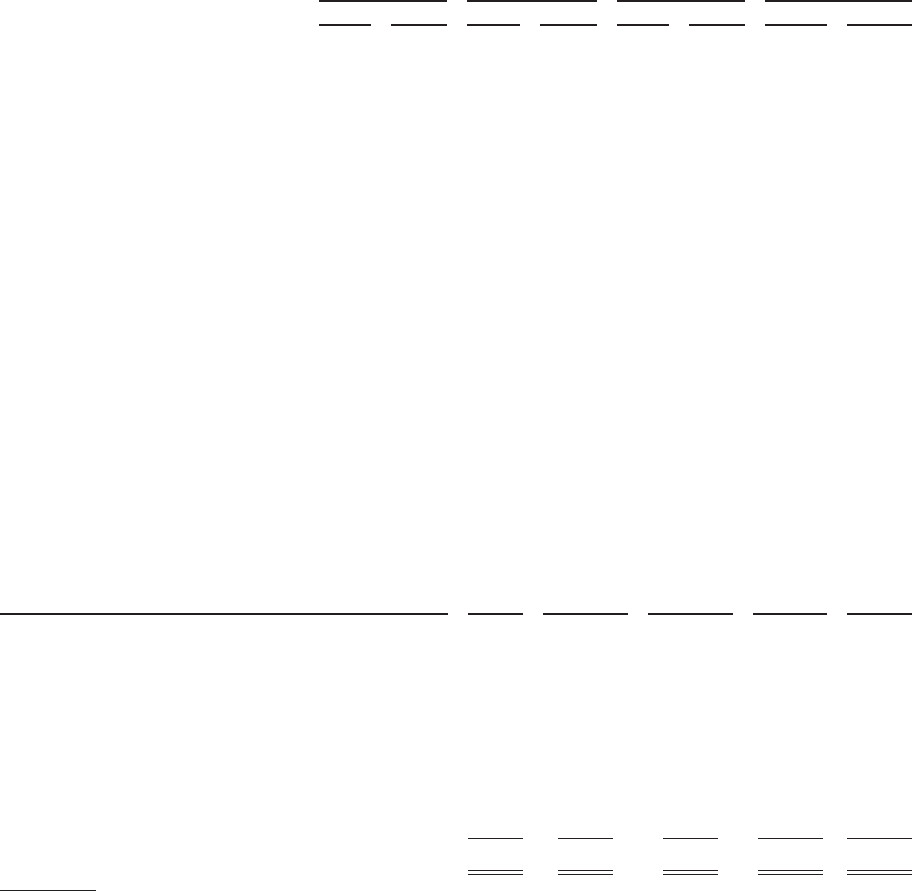

CONTRACTUAL OBLIGATIONS AND COMMITMENTS

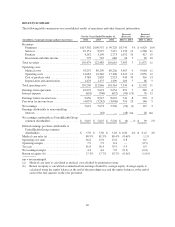

The following table summarizes future obligations due by period as of December 31, 2014, under our various

contractual obligations and commitments:

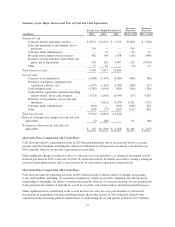

(in millions) 2015 2016 to 2017 2018 to 2019 Thereafter Total

Debt (a) ...................................... $2,103 $4,398 $3,193 $17,997 $27,691

Operating leases ............................... 491 715 533 464 2,203

Purchase obligations (b) ......................... 176 173 17 6 372

Future policy benefits (c) ........................ 127 282 289 1,917 2,615

Unrecognized tax benefits (d) .................... 2 — — 83 85

Other liabilities recorded on the Consolidated Balance

Sheet (e) ................................... 207 36 — 1,321 1,564

Other obligations (f) ............................ 143 126 44 33 346

Redeemable noncontrolling interests (g) ............ 83 767 538 — 1,388

Total contractual obligations ..................... $3,332 $6,497 $4,614 $21,821 $36,264

(a) Includes interest coupon payments and maturities at par or put values. The table also assumes amounts are

outstanding through their contractual term. See Note 8 of Notes to the Consolidated Financial Statements

included in Part II, Item 8, “Financial Statements” for more detail.

(b) Includes fixed or minimum commitments under existing purchase obligations for goods and services,

including agreements that are cancelable with the payment of an early termination penalty. Excludes

agreements that are cancelable without penalty and excludes liabilities to the extent recorded in our

Consolidated Balance Sheets as of December 31, 2014.

(c) Future policy benefits represent account balances that accrue to the benefit of the policyholders, excluding

surrender charges, for universal life and investment annuity products and for long-duration health policies

sold to individuals for which some of the premium received in the earlier years is intended to pay benefits to

be incurred in future years. See Note 2 of Notes to the Consolidated Financial Statements included in Part II,

Item 8, “Financial Statements” for more detail.

49