United Healthcare 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Medicare Advantage and Medicare Part D arrangements. The products and services under the AARP Program

include supplemental Medicare benefits (AARP Medicare Supplement Insurance), hospital indemnity insurance,

including insurance for individuals between 50 to 64 years of age, and other related products.

The Company’s arrangements with AARP extend to December 31, 2020 for the AARP Program and give the

Company an exclusive right to use the AARP brand on the Company’s Medicare Advantage and Medicare Part D

offerings until December 31, 2020, subject to certain limited exclusions.

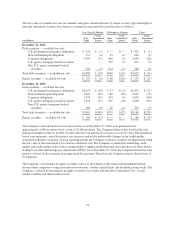

Pursuant to the Company’s agreement, AARP Program assets are managed separately from its general

investment portfolio and are used to pay costs associated with the AARP Program. These assets are invested at

the Company’s discretion, within investment guidelines approved by AARP. The Company does not guarantee

any rates of return on these investments and, upon any transfer of the AARP Program contract to another entity,

the Company would transfer cash equal in amount to the fair value of these investments at the date of transfer to

that entity. Because the purpose of these assets is to fund the medical costs payable, the rate stabilization fund

(RSF) liabilities and other related liabilities associated with this AARP contract, assets under management are

classified as current assets, consistent with the classification of these liabilities. Interest earnings and realized

investment gains and losses on these assets accrue to the overall benefit of the AARP policyholders through the

RSF. Accordingly, they are not included in the Company’s earnings. Interest income and realized gains and

losses related to assets under management are recorded as an increase to the RSF and were $86 million, $101

million and $109 million in 2014, 2013 and 2012, respectively.

The effects of changes in other balance sheet amounts associated with the AARP Program also accrue to the

overall benefit of the AARP policyholders through the RSF balance. Accordingly, the Company excludes the

effect of such changes in its Consolidated Statements of Cash Flows. For more detail on the RSF, see “Other

Policy Liabilities” below.

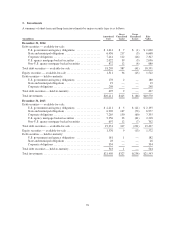

Other Current Receivables

Other current receivables include amounts due from pharmaceutical manufacturers for rebates and Medicare Part

D drug discounts, reinsurance and other miscellaneous amounts due to the Company.

The Company’s PBM businesses contract with pharmaceutical manufacturers, some of which provide rebates

based on use of the manufacturers’ products by its PBM businesses’ affiliated and non-affiliated clients. The

Company accrues rebates as they are earned by its clients on a monthly basis based on the terms of the applicable

contracts, historical data and current estimates. The PBM businesses bill these rebates to the manufacturers on a

monthly or quarterly basis depending on the contractual terms. The PBM businesses record rebates attributable to

affiliated clients as a reduction to medical costs. Rebates attributable to non-affiliated clients are accrued as

rebates receivable and a reduction of cost of products sold with a corresponding payable for the amounts of the

rebates to be remitted to non-affiliated clients in accordance with their contracts and recorded in the Consolidated

Statements of Operations as a reduction of product revenue. The Company generally receives rebates from two to

five months after billing.

For details on the Company’s Medicare Part D receivables see “Medicare Part D Pharmacy Benefits” below.

For details on the Company’s reinsurance receivable see “Future Policy Benefits and Reinsurance Receivable”

below.

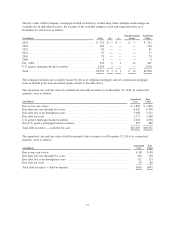

Medicare Part D Pharmacy Benefits

The Company serves as a plan sponsor offering Medicare Part D prescription drug insurance coverage under

contracts with CMS. Under the Medicare Part D program, there are seven separate elements of payment received

by the Company during the plan year. These payment elements are as follows:

•CMS Premium. CMS pays a fixed monthly premium per member to the Company for the entire plan year.

70