United Healthcare 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Contingent Liabilities

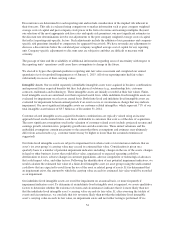

Because of the nature of our businesses, we are routinely involved in various disputes, legal proceedings and

governmental audits and investigations. We record liabilities for our estimates of the probable costs resulting

from these matters where appropriate. Our estimates are developed in consultation with legal counsel, if

appropriate, and are based upon an analysis of potential results, assuming a combination of litigation and

settlement strategies and considering our insurance coverage, if any, for such matters.

Estimates of costs resulting from legal and regulatory matters are inherently difficult to predict, particularly

where the matters: involve indeterminate claims for monetary damages or may involve fines, penalties or

punitive damages; present novel legal theories or represent a shift in regulatory policy; involve a large number of

claimants or regulatory bodies; are in the early stages of the proceedings; or could result in a change in business

practices. Accordingly, in many cases, we are unable to estimate the losses or ranges of losses for those matters

where there is a reasonable possibility or it is probable that a loss may be incurred. Similarly, the assessment of

the likelihood of assertion of unasserted claims involves significant judgment.

Given this inherent uncertainty, it is possible that future results of operations for any particular quarterly or

annual period could be materially affected by changes in our estimates or assumptions. We evaluate our related

disclosures in each reporting period. See Note 12 of Notes to the Consolidated Financial Statements included in

Part II, Item 8, “Financial Statements” for a discussion of specific legal proceedings including an assessment of

whether a reasonable estimate of the losses or range of loss could be determined.

LEGAL MATTERS

A description of our legal proceedings is presented in Note 12 of Notes to the Consolidated Financial Statements

included in Part II, Item 8, “Financial Statements.”

CONCENTRATIONS OF CREDIT RISK

Investments in financial instruments such as marketable securities and accounts receivable may subject us to

concentrations of credit risk. Our investments in marketable securities are managed under an investment policy

authorized by our Board of Directors. This policy limits the amounts that may be invested in any one issuer and

generally limits our investments to U.S. government and agency securities, state and municipal securities and

corporate debt obligations that are investment grade. Concentrations of credit risk with respect to accounts

receivable are limited due to the large number of employer groups and other customers that constitute our client

base. As of December 31, 2014, we had an aggregate $1.8 billion reinsurance receivable resulting from the sale

of our Golden Rule Financial Corporation life and annuity business in 2005. We regularly evaluate the financial

condition of the reinsurer and record the reinsurance receivable only to the extent that the amounts are deemed

probable of recovery. Currently, the reinsurer is rated by A.M. Best as “A+.” As of December 31, 2014, there

were no other significant concentrations of credit risk.

57