United Healthcare 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITEDHEALTH GROUP

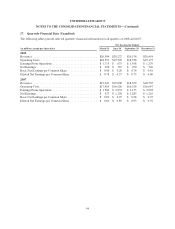

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

reporting, books and records and internal accounting control provisions of the federal securities laws. This

settlement is subject to approval by the U.S. District Court for the District of Minnesota.

On May 17, 2006, the Company received a subpoena from the U.S. Attorney for the Southern District of New

York requesting documents from 1999 to the date of the subpoena relating to its historical stock option practices.

On May 17, 2006, the Company received a document request from the Internal Revenue Service (IRS) seeking

documents relating to its historical stock option grants and other compensation for the persons who from 2003 to

May 2006 were the named executive officers in the Company’s annual proxy statements. As previously disclosed

in the Company’s 2006 Annual Report on Form 10-K, the Company believed that compensation expense related

to prior exercises of certain stock options by certain of the Company’s executive officers would no longer qualify

as deductible performance-based compensation in accordance with Internal Revenue Code Section 162(m)

(Section 162(m)) as a result of the revision of measurement dates that occurred as part of the Company’s review

of its historical stock option practices. In December 2007, the Company reached an agreement with the IRS

resolving Section 162(m) issues in connection with tax years through 2005. Pursuant to this agreement, the

Company paid $106 million in 2007 and an additional $20 million in the first quarter of 2008.

On June 6, 2006, the Company received a Civil Investigative Demand from the Minnesota Attorney General

requesting documents from January 1, 1997 to the date of the response concerning the Company’s executive

compensation and historical stock option practices. The Company filed an action in Ramsey County Court, State

of Minnesota, captioned UnitedHealth Group Incorporated vs. State of Minnesota, by Lori Swanson, Attorney

General, seeking a protective order, which was denied. The Company appealed the denial of the protective order

to the Minnesota Court of Appeals. On December 4, 2007, the Minnesota Court of Appeals acknowledged

limitations on the Minnesota Attorney General’s authority to issue a Civil Investigative Demand, but affirmed the

denial of a protective order. On February 27, 2008, the Minnesota Supreme Court declined to review the matter,

and the Company has since produced relevant and responsive materials.

The Company has also received requests for documents from U.S. Congressional committees relating to its

historical stock option practices and compensation of executives.

At the conclusion of any unresolved regulatory inquiries, the Company could be subject to regulatory or criminal

fines or penalties as well as other sanctions or other contingent liabilities, which could be material.

Litigation Matters. On March 29, 2006, the first of several shareholder derivative actions was filed against

certain of the Company’s current and former officers and directors in the United States District Court for the

District of Minnesota. The action has been consolidated with six other actions and is captioned In re

UnitedHealth Group Incorporated Shareholder Derivative Litigation. The consolidated amended complaint is

brought on behalf of the Company by several pension funds and other shareholders and names certain of the

Company’s current and former officers and directors as defendants, as well as the Company as a nominal

defendant. The consolidated amended complaint generally alleges that the defendants breached their fiduciary

duties to the Company, were unjustly enriched, and violated the securities laws in connection with the

Company’s historical stock option practices. The consolidated amended complaint seeks unspecified money

damages, injunctive relief and rescission of certain options. On June 26, 2006, the Company’s Board of Directors

created a Special Litigation Committee under Minnesota Statute 302A.241, consisting of two former Minnesota

Supreme Court Justices, with the power to investigate the claims raised in the derivative actions and shareholder

demands, and determine whether the Company’s rights and remedies should be pursued.

A consolidated derivative action, reflecting a consolidation of two actions, is also pending in Hennepin County

District Court, State of Minnesota. The consolidated complaint is captioned In re UnitedHealth Group

87