United Healthcare 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

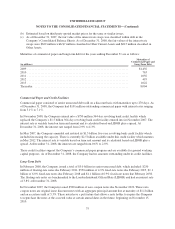

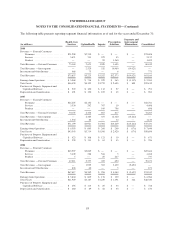

At December 31, 2007, prior to the adoption of FAS 159 on January 1, 2008, the amortized cost, gross unrealized

gains and losses, and fair value of cash, cash equivalents and investments associated with the Program, included

in Assets Under Management, were as follows:

(in millions) Amortized Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Cash and Cash Equivalents .............................. $ 441 $— $— $ 441

Debt Securities — Available-for-Sale:

U.S. Government and Direct Agency obligations ........ 621 22 — 643

State and Municipal obligations ...................... 25 — — 25

Corporate obligations .............................. 555 5 (7) 553

Mortgage-backed securities (a) ....................... 514 3 (3) 514

Total Debt Securities — Available-for-Sale ................. 1,715 30 (10) 1,735

Total Cash and Investments ............................. $2,156 $ 30 $ (10) $2,176

(a) Includes Agency-backed mortgage pass-through securities.

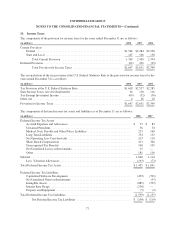

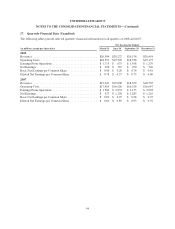

14. Fair Value of Financial Instruments

In the normal course of business, the Company invests in various financial assets, incur various financial

liabilities and enter into agreements involving derivative securities.

Fair values are disclosed for all financial instruments for which it is practicable to estimate fair value, whether or

not such values are recognized in the Consolidated Balance Sheets. Management obtains quoted market prices

for these disclosures.

The carrying amounts reported in the Consolidated Balance Sheets for cash and cash equivalents, premium and

other current receivables, unearned premiums, accounts payable and accrued expenses, income taxes payable,

and certain other current liabilities approximate fair value because of their short-term nature.

For a discussion of the methods and assumptions that were used to estimate the fair value of each class of

financial instrument see Note 5 to the Notes to Consolidated Financial Statements for information on Debt and

Equity Securities, Note 13 to the Notes to Consolidated Financial Statements for information on AARP and Note

9 to the Notes to Consolidated Financial Statements for information related to Interest Rate Swaps and Senior

Unsecured Notes.

The carrying values and fair values of the Company’s financial instruments at December 31 are as follows:

2008 2007

(in millions)

Carrying

Value

Fair

Value

Carrying

Value

Fair

Value

Assets

Debt Securities — Available-for-Sale .......................... $13,472 $13,472 $12,845 $12,845

Equity Securities — Available-for-Sale ......................... 477 477 383 383

Debt Securities — Held-to-Maturity ............................ 200 210 193 193

AARP Program-related Investments ............................ 1,941 1,941 1,735 1,735

Interest rate swaps .......................................... 622 622 — —

Liabilities

Senior Unsecured Notes ..................................... 12,693 10,941 9,564 9,239

85