United Healthcare 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

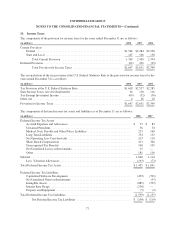

(b) Estimated based on third-party quoted market prices for the same or similar issues.

(c) As of December 31, 2007, the fair value of the interest rate swaps was classified within debt in the

Company’s Consolidated Balance Sheets. As of December 31, 2008, the fair values of the interest rate

swaps were $622 million with $7 million classified in Other Current Assets and $615 million classified in

Other Assets.

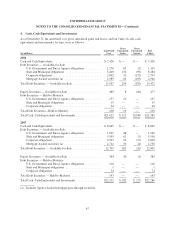

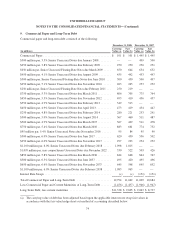

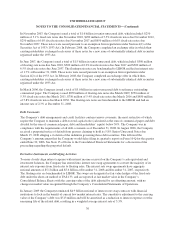

Maturities of commercial paper and long-term debt for the years ending December 31 are as follows:

(in millions)

Maturities of

Commercial Paper and

Long-Term Debt

2009 ..................................................................... $1,456

2010 ..................................................................... 763

2011 ..................................................................... 1,056

2012 ..................................................................... 493

2013 ..................................................................... 1,022

Thereafter ................................................................ 8,004

Commercial Paper and Credit Facilities

Commercial paper consisted of senior unsecured debt sold on a discount basis with maturities up to 270 days. As

of December 31, 2008, the Company had $101 million outstanding commercial paper with interest rates ranging

from 5.1% to 7.1%.

In November 2008, the Company entered into a $750 million 364-day revolving bank credit facility which

replaced the Company’s $1.5 billion 364-day revolving bank credit facility entered into in November 2007. The

interest rate is variable based on term and amount and is calculated based on LIBOR plus a spread. At

December 31, 2008, the interest rate ranged from 2.9% to 4.3%.

In May 2007, the Company amended and restated its $1.3 billion five-year revolving bank credit facility which

included increasing the capacity. There is currently $2.5 billion available under this credit facility which matures

in May 2012. The interest rate is variable based on term and amount and is calculated based on LIBOR plus a

spread. At December 31, 2008, the interest rate ranged from 0.6% to 2.0%.

These credit facilities support the Company’s commercial paper program and are available for general working

capital purposes. As of December 31, 2008, the Company had no amounts outstanding under its credit facilities.

Long-Term Debt

In February 2008, the Company issued a total of $3.0 billion in senior unsecured debt, which included: $250

million of floating-rate notes due February 2011, $550 million of 4.9% fixed-rate notes due February 2013, $1.1

billion of 6.0% fixed-rate notes due February 2018 and $1.1 billion of 6.9% fixed-rate notes due February 2038.

The floating-rate notes are benchmarked to the London Interbank Offered Rate (LIBOR) and had an interest rate

of 3.8% at December 31, 2008.

In November 2007, the Company issued $500 million of zero coupon notes due November 2022. These zero

coupon notes are original issue discount notes with an aggregate principal amount due at maturity of $1.1 billion

and an accretion yield of 5.3%. These notes have a put feature that allows a note holder to require the Company

to repurchase the notes at the accreted value at certain annual dates in the future, beginning on November 15,

2010.

75