United Healthcare 2008 Annual Report Download - page 52

Download and view the complete annual report

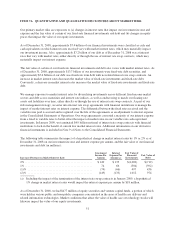

Please find page 52 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Intersegment revenues were eliminated in consolidation and amounted to $12.4 billion and $3.4 billion for 2007

and 2006, respectively.

Prescription Solutions earnings from operations increased largely due to the expansion of services to Medicare

Part D members discussed above. The operating margin was 2.0% in 2007, a decrease from 3.4% in 2006. The

decrease in operating margin reflected the comparatively lower margin earned in the high volume Ovations

Medicare Part D prescription drug service contracts.

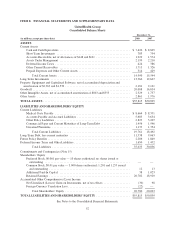

LIQUIDITY, FINANCIAL CONDITION AND CAPITAL RESOURCES

Liquidity and Financial Condition

We manage our cash, investments and capital structure to meet the short- and long-term obligations of our

business while maintaining liquidity and financial flexibility. We forecast, analyze and monitor our cash flows to

enable prudent investment management and financing within the confines of our financial strategy.

Our regulated subsidiaries generate significant cash flows from operations. A majority of the assets held by our

regulated subsidiaries are in the form of cash, cash equivalents and investments. After considering expected cash

flows from operating activities, we generally invest cash of regulated subsidiaries that exceeds our expected

short-term obligations in longer term, investment-grade, marketable debt securities to improve our overall

investment return. These investments are made pursuant to our Board of Directors’ approved investment policy,

which generally governs return objectives, regulatory limitations, tax implications and risk tolerances, which

focuses on preservation of capital, diversification and duration. Cash in excess of the capital needs of our

regulated entities is paid to their non-regulated parent companies, typically in the form of dividends, for general

corporate use, when and as permitted by applicable regulations.

Our non-regulated businesses also generate significant cash flows from operations for general corporate use.

Cash flows generated by these entities, combined with dividends from our regulated entities and financing

through the issuance of commercial paper and long-term debt, as well as the availability of committed credit

facilities, further strengthen our operating and financial flexibility. We generally use these cash flows to reinvest

in our businesses by making capital expenditures, expanding our services through business acquisitions and

repurchasing shares of our common stock, depending on market conditions.

Cash flows generated from operating activities, our primary source of liquidity, are principally from net earnings,

prior to depreciation and amortization and other non-cash expenses. As a result, any future decline in our

profitability may have a negative impact on our liquidity. The level of profitability of our risk-based business

depends in large part on our ability to accurately predict and price for health care and operating cost increases.

This risk is partially mitigated by the diversity of our other businesses, the geographic and customer diversity of

our risk-based business and our disciplined underwriting and pricing processes, which seek to match premium

rate increases with future health care costs.

42