United Healthcare 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

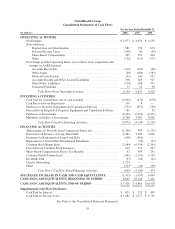

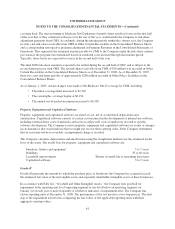

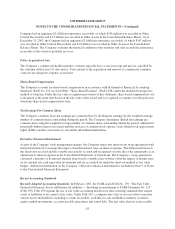

UnitedHealth Group

Consolidated Statements of Changes in Shareholders’ Equity

Common Stock Additional

Paid-In

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Total

Shareholders’

Equity(in millions) Shares Amount

Balance at January 1, 2006 .................... 1,358 $ 14 $ 7,510 $10,258 $ 33 $17,815

Net Earnings ................................. — — — 4,159 — 4,159

Unrealized Holding Losses on Investment Securities

During the Period, net of tax benefit of $7 ........ — — — — (15) (15)

Reclassification Adjustment for Net Realized Gains

Included in Net Earnings, net of tax expense of $1 . .

— — — — (3) (3)

Comprehensive Income ......................... 4,141

Issuances of Common Stock, and related tax

benefits ................................... 22 — 342 — — 342

Common Stock Repurchases .................... (40) (1) (2,344) — — (2,345)

Conversion of Convertible Debt .................. 5 — 282 — — 282

Share-Based Compensation, and related tax

benefits ................................... — — 616 — — 616

Common Stock Dividend ....................... — — — (41) — (41)

Balance at December 31, 2006 .................. 1,345 $ 13 $ 6,406 $14,376 $ 15 $20,810

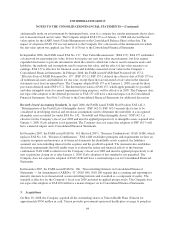

Net Earnings ................................. — — — 4,654 — 4,654

Unrealized Holding Gains on Investment Securities

During the Period, net of tax expense of $60 ...... — — — — 107 107

Reclassification Adjustment for Net Realized Gains

Included in Net Earnings, net of tax expense of $14 . . .

— — — — (24) (24)

Comprehensive Income ......................... 4,737

Issuances of Common Stock, and related tax

benefits ................................... 33 1 590 — — 591

Common Stock Repurchases .................... (125) (1) (6,598) — — (6,599)

Conversion of Convertible Debt .................. — — 24 — — 24

Share-Based Compensation, and related tax

benefits ................................... — — 602 — — 602

Adjustment to Adopt FIN 48 .................... — — (1) (61) — (62)

Common Stock Dividend ....................... — — — (40) — (40)

Balance at December 31, 2007 .................. 1,253 $ 13 $ 1,023 $18,929 $ 98 $20,063

Net Earnings ................................. — — — 2,977 — 2,977

Unrealized Holding Losses on Investment Securities

During the Period, net of tax benefit of $76 ....... — — — — (132) (132)

Reclassification Adjustment for Net Realized Losses

Included in Net Earnings, net of tax benefit of $2 . . — — — — 4 4

Foreign Currency Translation Loss ................ (22) (22)

Comprehensive Income ......................... 2,827

Issuances of Common Stock, and related tax

benefits ................................... 20 — 272 — — 272

Common Stock Repurchases .................... (72) (1) (1,596) (1,087) — (2,684)

Share-Based Compensation, and related tax

benefits ................................... — — 339 — — 339

Common Stock Dividend ....................... — — — (37) — (37)

Balance at December 31, 2008 .................. 1,201 $ 12 $ 38 $20,782 $ (52) $20,780

See Notes to the Consolidated Financial Statements.

54