Under Armour 2007 Annual Report Download - page 68

Download and view the complete annual report

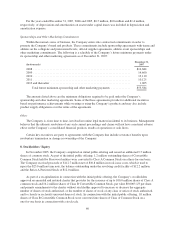

Please find page 68 of the 2007 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.carries a line of credit fee equal to the available but unused borrowings which can vary from 0.1% to 0.5%. As of

December 31, 2007, the Company’s availability was $100.0 million based on its domestic inventory and accounts

receivable balances.

This financing agreement contains a number of restrictions that limit the Company’s ability, among other

things, to pledge its accounts receivable, inventory, trademarks and most of its other assets as security in its

borrowings or transactions; pay dividends on stock; redeem or acquire any of its securities; sell certain assets;

make certain investments; guaranty certain obligations of third parties; undergo a merger or consolidation; or

engage in any activity materially different from those presently conducted by the Company.

If net availability under the financing agreement falls below a certain threshold as defined in the agreement,

the Company would be required to maintain a certain leverage ratio and fixed charge coverage ratio as defined in

the agreement. This financing agreement also provides the lenders with the ability to reduce the available

revolving credit line amount under certain conditions even if the Company is in compliance with all conditions of

the agreement. The Company’s net availability as of December 31, 2007 was above the threshold for compliance

with the financial covenants and the Company was in compliance with all covenants as of December 31, 2007.

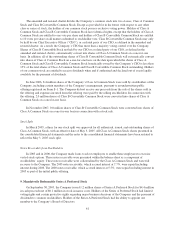

In September 2005, the Company entered into a second amended and restated financing agreement with a

lending institution that was to terminate in 2010. Under this financing agreement, the Company was required to

maintain prescribed levels of tangible net worth as defined in the agreement and was collateralized by

substantially all of the assets of the Company. The Company paid and recorded $1.1 million in deferred financing

costs as part of the financing agreement which was comprised of both a $25.0 million term note and a $75.0

million revolving credit facility. In November 2005, the Company repaid the $25.0 million term note plus

interest and the balance outstanding under the revolving credit facility of $12.2 million with proceeds from the

initial public offering (see Note 8). The term note portion of the financing agreement was then terminated and as

such the Company expensed $0.3 million of deferred financing costs within interest expense. With the

termination of the term note, the Company’s trademarks and other intellectual property were released as a

component of the collateral. The weighted average interest rate on the term note was 9.4%.

The weighted average interest rate on the revolving credit facilities for the years ended December 31, 2007

and 2005 was 6.3% and 5.5%, respectively. During the year ended December 31, 2006, no balance was

outstanding.

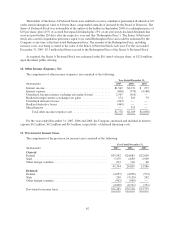

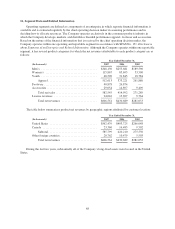

Long Term Debt

In March 2005, the Company entered into a loan and security agreement to finance the acquisition of

qualifying capital investments. The Company has up to $17.0 million available under this loan and security

agreement. This agreement is collateralized by a first lien on these assets and is otherwise subordinate to the

revolving credit facility. At December 31, 2007, the outstanding principal balance was $13.4 million under this

agreement. The weighted average interest rate on outstanding borrowings was 6.5%, 6.3% and 5.7% for the years

ended December 31, 2007, 2006 and 2005, respectively.

In December 2003, the Company entered into a master loan and security agreement that was subordinate to

the revolving credit facilities. Under this agreement the Company borrowed $1.3 million for the purchase of

qualifying furniture and fixtures. The interest rate was 7.0% annually, and principal and interest payments were

due monthly through February 2006. The outstanding principal balance was repaid during February 2006.

58