Under Armour 2007 Annual Report Download - page 43

Download and view the complete annual report

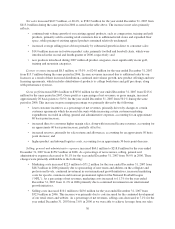

Please find page 43 of the 2007 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• increased direct to consumer higher margin sales, accounting for an approximate 50 basis point

increase; partially offset by

• increased sales returns and allowances, accounting for an approximate 70 basis point decrease; and

• lower gross margin attributable to the introduction of our footwear products which had lower profit

margins than our apparel products, accounting for an approximate 120 basis point decrease.

Selling, general and administrative expenses increased $58.7 million, or 58.6%, to $158.7 million in 2006

from $100.0 million in 2005. As a percentage of net revenues, selling, general and administrative expenses

increased to 36.9% in 2006 from 35.6% in 2005. These changes were primarily attributable to the following:

• Marketing costs increased $17.8 million to $48.3 million in 2006 from $30.5 million in 2005 primarily

due to the footwear promotional rights for the NFL and sponsorship of new teams on the collegiate

level, increased in-store marketing signage and fixtures, film and print advertising campaigns,

increased costs to support the development of our website and catalog initiatives, and marketing

payroll. As a percentage of net revenues, marketing costs increased to 11.2% in 2006 from 10.8% in

2005 due primarily to the items described above.

• Selling costs increased $14.5 million to $32.9 million in 2006 from $18.4 million in 2005. This

increase was primarily due to the continued investment in our international growth initiatives,

including the establishment of our European distribution, the continued development of our retail outlet

stores, increased headcount in our sales force, and additional trade show and sales meeting

expenditures. As a percentage of net revenues, selling costs increased to 7.6% in 2006 from 6.6% in

2005 primarily due to our international growth initiatives and the continued development of our retail

outlet stores.

• Product innovation and supply chain costs increased $10.3 million to $35.8 million in 2006 from $25.5

million in 2005. The increase was primarily due to higher personnel costs for the design and sourcing

of our expanding footwear and apparel lines and higher distribution facilities personnel and operating

costs to support our growth in net revenues. As a percentage of net revenues, product innovation and

supply chain costs decreased to 8.3% in 2006 from 9.1% in 2005 primarily due to lower distribution

facility personnel and operating costs as a percentage of net revenues.

• Corporate services increased $16.0 million to $41.7 million in 2006 from $25.7 million in 2005. This

increase was primarily attributable to increased corporate costs relating to the continued development

of our retail stores and website, additional corporate facility personnel and operating costs to support

our growth, post-implementation consulting costs and depreciation expense related to our new ERP

system, as well as increased audit fees, insurance and SOX compliance costs. These increases were

partially offset by lower bonus expense in 2006. As a percentage of net revenues, corporate services

increased to 9.7% in 2006 from 9.1% in 2005 due to the items noted above.

Income from operations increased $21.1 million, or 58.9%, to $56.9 million in 2006 from $35.8 million in

2005. Income from operations as a percentage of net revenues increased to 13.2% in 2006 from 12.7% in 2005.

This increase was a result of an increase in gross margin partially offset by an increase in selling, general and

administrative expenses as a percentage of net revenues.

Other income (expense), net increased $5.0 million to $2.2 million in other income, net in 2006 from

$2.8 million in other expense, net in 2005. This increase was primarily due to the decrease in interest expense

due to the repayment of our credit facility in November 2005, along with interest income earned on a portion of

the proceeds from our initial public offering.

Provision for income taxes increased $6.8 million to $20.1 million in 2006 from $13.3 million in 2005. In

2006, we adjusted our projected annual effective tax rate for the year downward to reflect the impact of a new

state tax credit earned. As a result, our effective tax rate was 34.0% for 2006 compared to 40.2% for 2005.

33