Under Armour 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

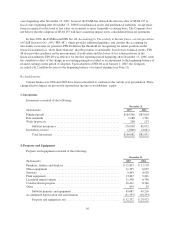

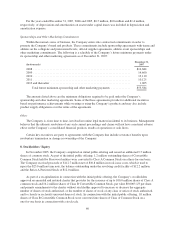

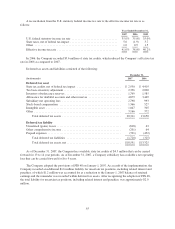

Construction in progress primarily includes software costs relative to systems not yet placed in use and

in-store fixtures and displays not yet placed in service.

Depreciation and amortization expense related to property and equipment was $12.9 million, $9.0 million

and $6.2 million for the years ended December 31, 2007, 2006 and 2005, respectively.

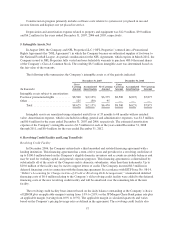

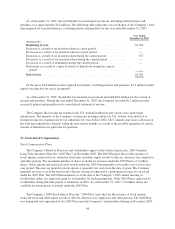

5. Intangible Assets, Net

In August 2006, the Company and NFL Properties LLC (“NFL Properties”) entered into a Promotional

Rights Agreement (the “NFL Agreement”) in which the Company became an authorized supplier of footwear to

the National Football League. As partial consideration for the NFL Agreement, which expires in March 2012, the

Company issued to NFL Properties fully vested and non-forfeitable warrants to purchase 480.0 thousand shares

of the Company’s Class A Common Stock. The resulting $8.5 million intangible asset was determined based on

the fair value of the warrants.

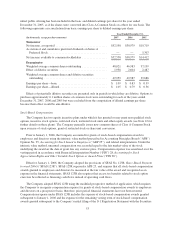

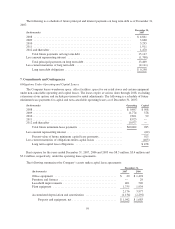

The following table summarizes the Company’s intangible assets as of the periods indicated:

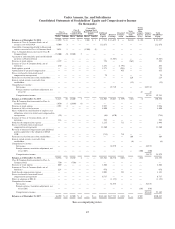

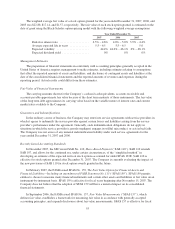

December 31, 2007 December 31, 2006

(In thousands)

Gross

Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Intangible assets subject to amortization:

Footwear promotional rights .......... $8,500 $(2,125) $6,375 $8,500 $(625) $7,875

Other ............................. 125 (30) 95 — — —

Total ......................... $8,625 $(2,155) $6,470 $8,500 $(625) $7,875

Intangible assets are amortized using estimated useful lives of 33 months to 68 months with no residual

value. Amortization expense, which is included in selling, general and administrative expenses, was $1.5 million

and $0.6 million for the years ended December 31, 2007 and 2006, respectively. The estimated amortization

expense of the Company’s intangible assets is $1.5 million for each of the years ended December 31, 2008

through 2011, and $0.4 million for the year ended December 31, 2012.

6. Revolving Credit Facility and Long Term Debt

Revolving Credit Facility

In December 2006, the Company entered into a third amended and restated financing agreement with a

lending institution. This financing agreement has a term of five years and provides for a revolving credit line of

up to $100.0 million based on the Company’s eligible domestic inventory and accounts receivable balances and

may be used for working capital and general corporate purposes. This financing agreement is collateralized by

substantially all of the assets of the Company and its domestic subsidiaries, other than their trademarks. Up to

$10.0 million of the facility may be used to support letters of credit. The Company incurred $0.3 million in

deferred financing costs in connection with the financing agreement. In accordance with EITF Issue No. 98-14,

“Debtor’s Accounting for Changes in Line-of-Credit or Revolving-Debt Arrangements,” unamortized deferred

financing costs of $0.6 million relating to the Company’s old revolving credit facility were added to the deferred

financing costs of the new revolving credit facility and will be amortized over the remaining life of the new

facility.

The revolving credit facility bears interest based on the daily balance outstanding at the Company’s choice

of LIBOR plus an applicable margin (varying from 1.0% to 2.0%) or the JP Morgan Chase Bank prime rate plus

an applicable margin (varying from 0.0% to 0.5%). The applicable margin is calculated quarterly and varies

based on the Company’s pricing leverage ratio as defined in the agreement. The revolving credit facility also

57