Under Armour 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

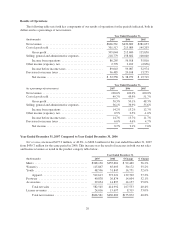

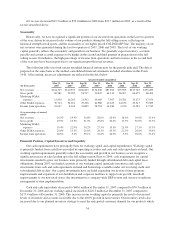

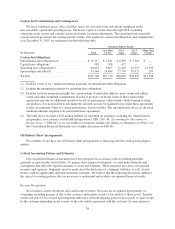

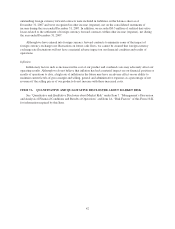

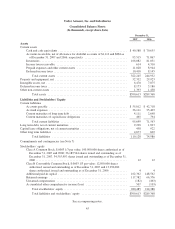

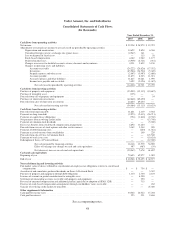

Contractual Commitments and Contingencies

We lease warehouse space, office facilities, space for our retail stores and certain equipment under

non-cancelable capital and operating leases. The leases expire at various dates through 2018, excluding

extensions at our option, and contain various provisions for rental adjustments. The operating leases generally

contain renewal provisions for varying periods of time. Our significant contractual obligations and commitments

as of December 31, 2007 are summarized in the following table:

Payments Due by Period

(In thousands) Total

Less Than

1 Year

1to3

Years

3to5

Years

More Than

5 Years

Contractual obligations

Subordinated debt obligations(1) ................. $ 15,117 $ 4,841 $ 6,895 $ 3,381 $ —

Capital lease obligations ........................ 985 508 477 — —

Operating lease obligations(2) ................... 60,062 9,697 21,465 16,515 12,385

Sponsorships and other(3) ...................... 53,584 14,684 27,770 10,927 203

Total(4) ..................................... $129,748 $29,730 $56,607 $30,823 $12,588

(1) Includes a total of $1.7 million in interest payments on subordinated debt obligations.

(2) Includes the minimum payments for operating lease obligations.

(3) Includes footwear promotional rights fees, sponsorships of individual athletes, sports teams and athletic

events and other marketing commitments in order to promote our brand. Some of these sponsorship

agreements provide for additional incentives based on performance achievements while wearing or using

our products. It is not possible to determine the amounts we may be required to pay under these agreements

as they are primarily subject to certain performance based variables. The amounts listed above are the fixed

minimum amounts required to be paid under these agreements.

(4) The table above excludes a $2.6 million liability for uncertain tax positions, including the related interest

and penalties, in accordance with FASB Interpretation (“FIN”) No. 48 “Accounting for Uncertainty in

Income Taxes,” (“FIN 48”) as we are unable to reasonably estimate the timing of settlement (see Note 11 to

the Consolidated Financial Statements for a further discussion on FIN 48).

Off-Balance Sheet Arrangements

We currently do not have any off-balance sheet arrangements or financing activities with special-purpose

entities.

Critical Accounting Policies and Estimates

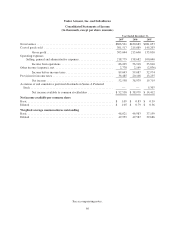

Our consolidated financial statements have been prepared in accordance with accounting principles

generally accepted in the United States. To prepare these financial statements, we must make estimates and

assumptions that affect the reported amounts of assets and liabilities. These estimates also affect our reported

revenues and expenses. Judgments must be made about the disclosure of contingent liabilities as well. Actual

results could be significantly different from these estimates. We believe that the following discussion addresses

the critical accounting policies that are necessary to understand and evaluate our reported financial results.

Revenue Recognition

Net revenues consist of both net sales and license revenues. Net sales are recognized upon transfer of

ownership, including passage of title to the customer and transfer of risk of loss related to those goods. Transfer

of title and risk of loss is based upon shipment under free on board shipping point for most goods or upon receipt

by the customer depending on the country of the sale and the agreement with the customer. In some instances,

38